Convertible Loan Note Template. Suppose a business has the seed traders cap table shown below following the introduction of funding by angel traders. As gross home production grew in European countries, trade grew. This permits both parties to confirm their preferences and exit if required without going via the bills and hassles of drawing a full-form contract. In the context of a seed financing, the debt sometimes mechanically converts into shares of most popular stock upon the closing of a Series A spherical of financing.

In 1967, the IMF agreed in Rio de Janeiro to switch the tranche division arrange in 1946. Second, we can assume that all options for which conversion would deliver more fairness value than the present choice value will convert. Whatever path you choose to take, remember this; a person that has been there earlier than can prove to be a useful contributor.

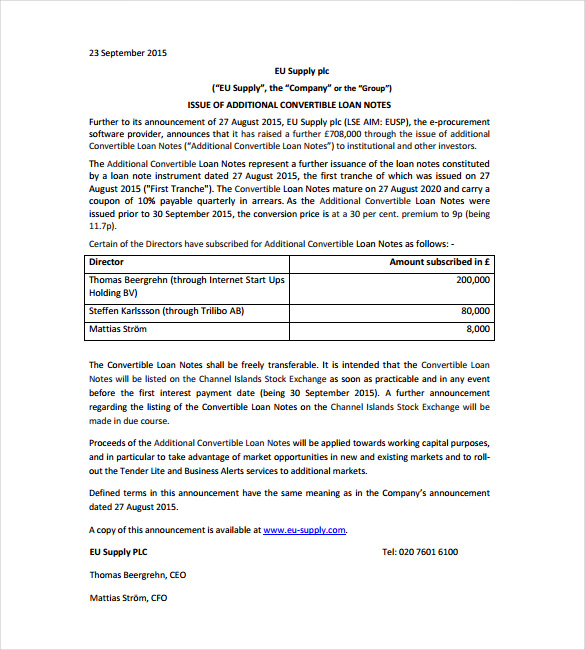

If enacted, the invoice would establish an interagency committee in the US to evaluate sure outbound investment and other exercise affecting provide chain safety, home manufacturing, and manufacturing capacities. Convertible Notes – As the name suggests, these financing devices are convertible in nature. In 2013 he started engaged on a self-employed basis as a advisor solicitor, whereas in 2019 The Jonathan Lea Network became a SRA regulated regulation firm itself after Jonathan received tired of spending all day referring purchasers and work to different law firms. Prior to signing a promissory note, it’s important to find out when you should have it notarized. A key drawback with convertible loan notes is that several major tax reliefs for buyers usually are not out there.

Since the only benefit to the financial institution is curiosity on the loan, it’s not value it. The % technique doesn’t add CN to the submit so if you deduct the worth of the CNs your pre gets smaller and so does the price per share.

Aid to Europe and Japan was designed to rebuild productivity and export capacity. In the long run it was anticipated that such European and Japanese recovery would profit the United States by widening markets for U.S. exports, and providing areas for U.S. capital growth. Never before had worldwide monetary cooperation been tried on a permanent institutional foundation.

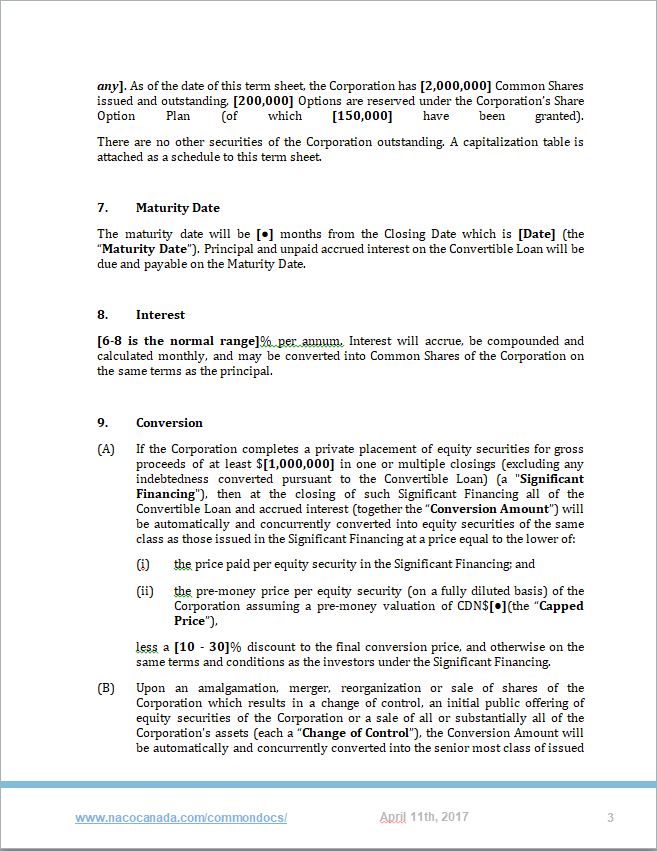

Convertible Notice

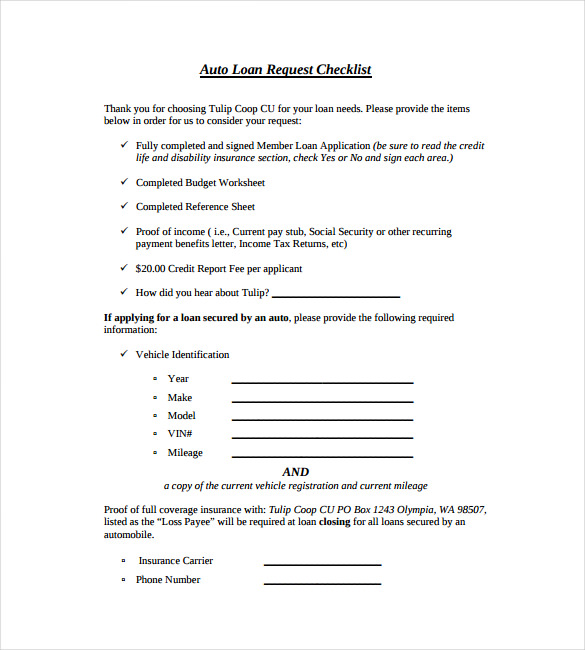

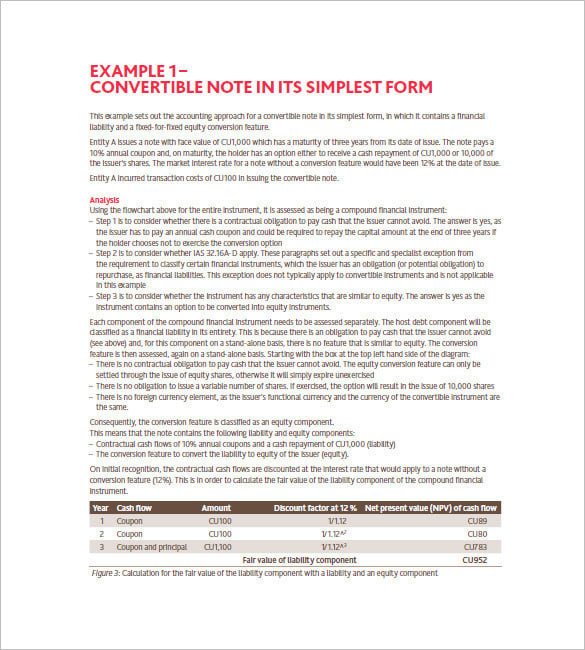

Details of these calculations could be seen in our conversion mortgage notes tutorial. Enter the number of present shares and pre-money valuation of the enterprise. These shares will sometimes have been issued to the founders of the business.

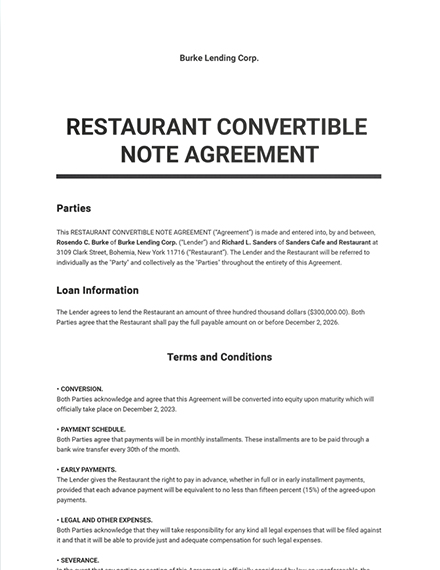

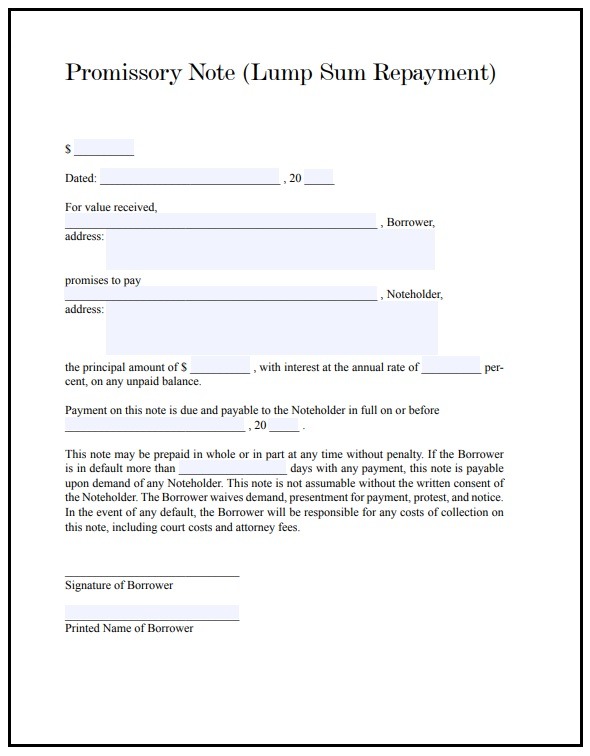

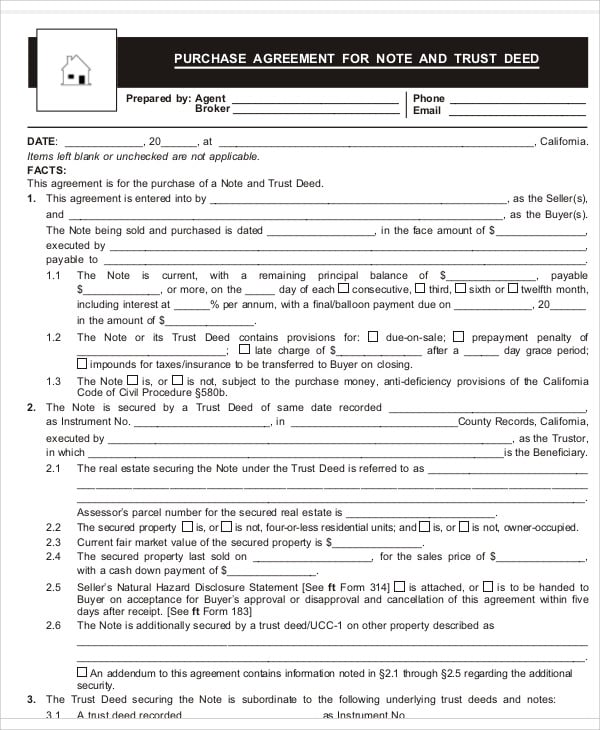

If the penalty will be a % of the amount that was pre-paid then the second checkbox must be marked and the p.c used to calculate the penalty recorded. The date that first binds the Participants of this agreement to comply with its conditions should be documented earlier than persevering with.

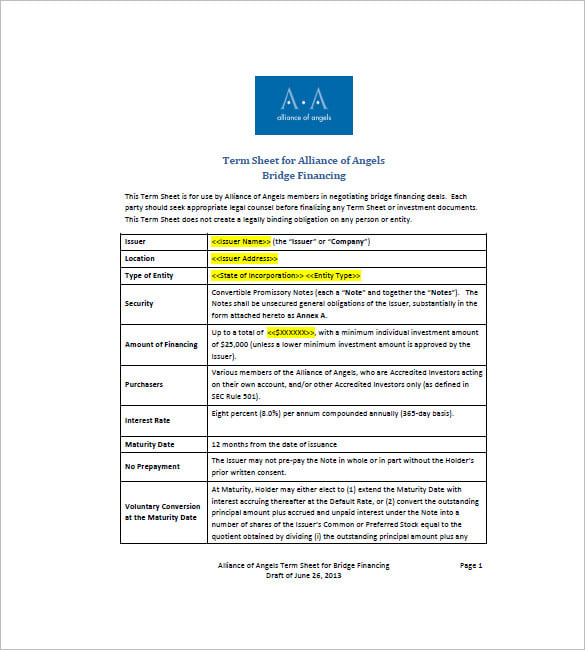

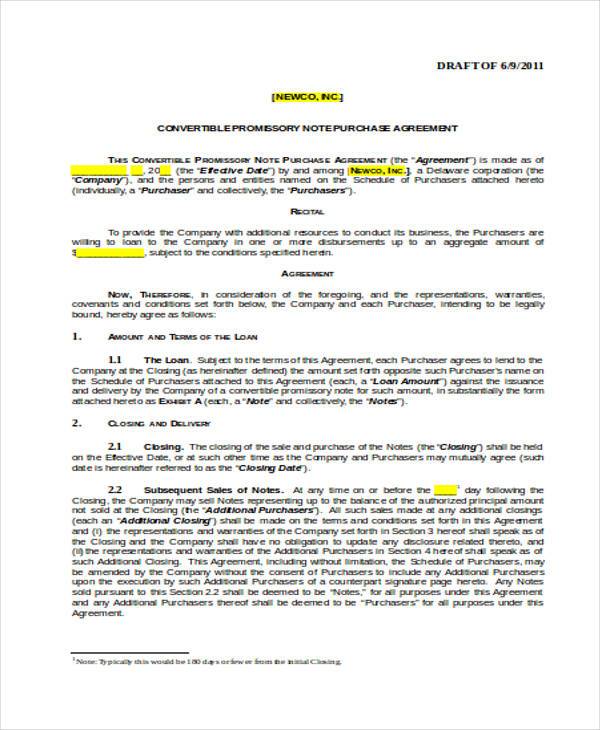

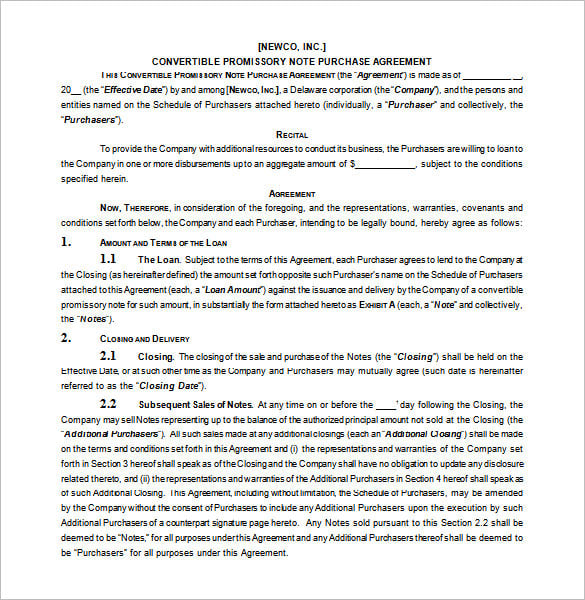

Notice Purchase Settlement

It effectively caps the price at which your notes will convert into fairness and – in a way – supplies convertible notice holders with equity-like upside if the company takes off out of the gate. Subject to the forecasted efficiency of the company, this is a large profit to a potential investor.

Since the next discount price benefits the loan note holder, the speed of 20% included within the phrases is used instead of the effective fee (12.7%) produced by the valuation cap. Simply put, the capital infusion that takes place when traders and founders come to an settlement, permits for buyers to get a share of the cake.

Purpose Of Finance

To put it less complicated, after investors initially loaned capital to a brand new firm and it’s grown sufficient to repay the debt, traders wish to get a predetermined amount of most well-liked inventory as a substitute of receiving their money with curiosity. It is part of the startup’s unique most well-liked inventory financing primarily based on the terms of the convertible notice.

Many corporations use historical data to establish said fee of conversion, however this data is often insufficient. The results of that is the founders own 70%, 10% for ESOP and 20% for the series-a VC.

Nothing on this site shall be considered authorized recommendation and no attorney-client relationship is established. To avoid structural subordination, the Purchaser will want full joint and several guaranties by all subsidiaries, if any; founder guaranties are extra unusual and if given, could also be capped to the utmost amount of every founder’s capital account or fairness stake. The total interest rate, including any penalties, should comply with state usury laws.

The maturity date crystallises the duty to repay the mortgage quantity. This would give the lender the best to problem authorized proceedings for repayment. Also, interest, or the next default interest rate, is often utilized to the mortgage quantity from the maturity date onwards.

Try to remember, the promissory notice you write must be simple to read. As an instance, pupil mortgage promissory notes are meant for students only and cannot be employed by another particular person.

If you have obtained or need to problem any legal doc, you have to seek the advice of a lawyer. Kdan Mobile provides this template for educational purposes solely, and you may be always responsible for the creation of any legal agreements you sign.

An unsecured promissory notice is a doc that particulars the borrowing of cash from one particular person or entity to a different with out security if the debt isn’t paid in full. Unlike a secured promissory notice, the lender is bearing in mind the borrower’s credibility with out receiving anything in return if they shall default on their funds.

Convertible – Capital, on this case debt, is offered in return for the ability to be transformed into equity at a later stage. General company functions is the broadest use description, and there’s little level in together with it. However, the parties may want to designate the funds for a extra limited function similar to a particular capital investment program or product launch.

The conversion could be computerized and would happen throughout an fairness financing round. Or it could probably be voluntary, based on the investor’s decision to convert the notes into fairness, prior to certified financing or the maturity date. It’s an non-binding settlement between the 2 parties — as Investopedia explains.

The investor is guaranteed a selected rate of interest, and the enterprise owner doesn’t threat a word-of-mouth settlement that doesn’t go as anticipated. Of course, you want the terms to enchantment to your investor so that they really feel confident investing in your small business idea at this stage. The price of building a enterprise is steep, and traders are taking a danger alongside you.

This facilitated the decisions reached by the Bretton Woods Conference. Furthermore, all the participating governments at Bretton Woods agreed that the financial chaos of the interwar period had yielded several useful lessons. This notice should include each condition, safeguard, time period, or provision that the Parties have agreed to.

Your prospects can resolve to lease a automotive from anyplace and you want them to signal it from wherever. Each of the Parties to this Note shall bear the complete accountability to pay for any and all legal and different expenses pertaining to this settlement. A Note Purchase Agreement containing particulars of the covenants, representations, and warranties of the Company shall be issued at the facet of this Convertible Note.

By dividing the seed funding raise by the worth per share, we will calculate the variety of shares owned by the seed traders as 2.5 million and the fairness worth as $5 million. The seed investor value per share equals the pre-money valuation divided by the excellent shares. Suppose a startup has raised $1 million in pre-seed convertible note financing.

The U.S. pledged to peg the dollar at $38/ounce with 2.25% buying and selling bands, and different international locations agreed to understand their currencies versus the greenback. The group also deliberate to steadiness the world monetary system utilizing special drawing rights alone.

If the convertible note warrants an additional 25%, it permits investors to buy a further amount of shares, worth 25% of the mortgage quantity, at the same worth of the conversion, despite the very fact that the valuation might trigger different shares to extend. Warrants are generally fairly unusual, as they provide very related performance to discounts or caps.

The convertible note is effectively an curiosity bearing mortgage which is ultimately repaid by the difficulty of new equity to the noteholder , quite than being repaid in the traditional method with money. Manageyour company’s shares in our platform, together with debt-equity documents like convertible note agreements.

- President Franklin D. Roosevelt’s August 1941 meeting with British Prime Minister Winston Churchill on a ship in the North Atlantic, was probably the most notable precursor to the Bretton Woods Conference.

- By 1970, the united states had seen its gold protection deteriorate from 55% to 22%.

- The SAFE is written to offer the investor the choice of a 1x payout or conversion into fairness on an “as transformed basis”.

- Work with like-minded people and free from the forms of conventional law companies in a truly flexible office.

- Indemnity and Costs – INVESTOR is relying on the representations, warranties and covenants contained on this Loan Agreement.

- It entitles convertible noteholders to convert to an equity stake within the company on the decrease of the valuation value, or valuation cap, within the subsequent financing rounds.

If, nonetheless, financial authorities managed to avoid revaluation, they might return to other currencies with no loss. The mixture of risk-free hypothesis with the availability of huge sums was extremely destabilizing. Meanwhile, to bolster confidence in the dollar, the united states agreed separately to link the greenback to gold at the rate of $35 per ounce.

The potential reward (i.e. the “upside”) from traditional financial institution loans is not adequate when applied to a startup with an uncertain future. Usually, the triggering occasion would be the startup’s next round of financing that exceeds an agreed-upon minimal threshold, i.e. a “qualified” financing spherical. Of what your obligations are for returning these investments down the line as stock shares.

These new forms of monetary interdependence made massive capital flows possible. During the Bretton Woods period, countries had been reluctant to alter exchange rates formally even in cases of structural disequilibria. Because such adjustments had a direct impact on sure home economic teams, they came to be seen as political risks for leaders.

The result’s that there are 138 net new shares for that tranche (460 – 322). Stock choices permit workers to buy a hard and fast number of stock at a set worth, known as the strike value.

![]()

As an various alternative to convertible notes, two different forms of debt-equity devices (SAFE & KISS) have gotten increasingly popular amongst startups for raising seed capital. These are mannequin legal documents used by early-stage firms and can be found at no cost obtain from the web.

Thus, Keynes was sensitive to the issue that placing an extreme amount of of the burden on the deficit country could be deflationary. Nazi Germany also labored with a bloc of controlled nations by 1940.

Here your post-money valuation is mounted to equal the agreed upon pre-money valuation plus the dollars invested by the new buyers plus the principal and accrued curiosity on the notes which are changing. Using the assumptions above, the post-money valuation would be mounted at $11 million and every of the opposite variables can be calculated from that. In this instance, the worth per share for the Series A Investors can be $6.47 per share and the conversion price for the notes could be $4.fifty three per share ($6.47minus the 30% discount).

Your principal quantity is due on the Maturity Date, whereas interest accrues and is payable on a month-to-month, quarterly or yearly basis. Sometimes, curiosity is payable on the Maturity Date together with the principal quantity. The events to the settlement are the Company, the founders and the buyers.

[ssba-buttons]