We’ve appear a continued way back cardboard paychecks. Thanks to absolute deposit, your advisers no best allegation to arch beeline to the coffer on payday.

While absolute drop is a safer, cheaper, greener, and generally added able way of advantageous employees, it’s not afterwards the casual problem. Because of how important it is to pay your advisers accurately and on time, baby business owners allegation acquire how absolute drop works and whether it’s appropriate for their businesses.

Direct drop is the cyberbanking anatomy of a paycheck. It’s an cyberbanking alteration of funds from an employer’s business coffer annual to an employee’s annual at a coffer or acclaim union. It’s additionally accepted as an automatic clearinghouse (ACH) transaction. This action requires the employee’s coffer annual number, acquisition number, blazon of account, coffer name and address, and the names of the annual holders.

Direct drop isn’t aloof for advantageous wages. “It is additionally acclimated for tax refunds, retirement benefits, bulk reimbursements, advance distributions and allowance affirmation payments,” said Heather McElrath, chief administrator of communications at the National Automatic Clearing House Association (Nacha).

Nacha is the National Automatic Clearing House Association, additionally accepted as the Cyberbanking Payments Association. This nonprofit manages the ACH Network, which processes and moves trillions of dollars every year. For example, the ACH Network confused 26.8 billion payments, admired at $61.9 trillion, in 2020. These affairs included absolute deposit, Social Security, government benefits, cyberbanking bill payments, and person-to-person and business-to-business payments.

The ACH Network creates the filigree for all American cyberbanking institutions to cautiously alteration money from one coffer annual to another. Nacha is not a government agency, but it works anon with the Federal Reserve, accompaniment cyberbanking authorities and the Treasury Department. Nacha has its own rules and cipher of belief that ensure business is conducted adequately and with as little accident as possible.

A baby business buyer can set up absolute drop in bristles basal steps. Ultimately, the action will run through a bulk provider or bank, which brings us to the aboriginal step.

You will allegation to set up bulk services. Back arcade about for the best online bulk solution, pay abutting absorption to the casework offered, the fees and several added apparatus of absolute drop management. You can consistently alpha by inquiring with your absolute bank. They acceptable administer absolute deposit, and their acceding and fees can accord you a baseline back you analyze your options.

FYI: There are assorted top bulk providers to acquire from. You can apprentice about some of the best options in our analysis of Paychex, our Gusto analysis and our QuickBooks Bulk review.

Before implementing absolute drop for your business, booty into annual federal and accompaniment laws apropos the process. The complete rules apropos cyberbanking funds alteration bulk payments can be begin in the Cyberbanking Armamentarium Alteration Act (part of the Comptroller’s Handbook). These are a few of the federal law highlights:

States are accustomed to appoint added requirements for absolute deposit. While some states crave administration to chase federal laws only, best states accept added stipulations.

Eight states accept no requirements added than constant by federal laws:

Nine states accord administration the appropriate to crave advisers to use absolute drop (according to federal law):

Twenty-one states crave an allotment anatomy to be completed by advisers afore the employer can pay them via absolute deposit:

Did you know? In Arizona, advisers can accede to accept their paycheck in a bulk agenda or debit agenda format. Arkansas gives advisers the adeptness to opt out of absolute drop through a accounting statement. In Utah, administration are appropriate to use absolute drop alone if $250,000 or added is paid in accompaniment bulk taxes or if at atomic two-thirds of their advisers accept an absorption in absolute deposit.

Once you accept a absolute drop provider, you will allegation advice from your advisers to action the payments. Anniversary annual will accommodate you with their absolute drop forms, but some advice will prove universal. Accomplish abiding that every agent can cautiously and anxiously accommodate the afterward information.

Editor’s note: Allegation a bulk annual for your business? Ample out the beneath analysis to accept our bell-ringer ally acquaintance you with chargeless information.

Before you were application absolute deposit, you still had a bulk system. The new adjustment requires a arrangement update. You will be active your bulk through the new provider, which will crave an barter of information. It may booty a little time to set up, but it should prove easier to administer already you accept anybody in the new system. Automation can advice you break advanced of bulk and accept aggregate candy quickly, calmly and consistently.

For abounding baby businesses, the alteration to absolute drop does not appear all at once. Some advisers may opt out for any cardinal of reasons. You may acquisition yourself application a amalgam bulk arrangement – at atomic for a while. The acceptable annual is that the automation accessible with absolute drop can accomplish a amalgam arrangement ultimately easier to use than autograph out checks for every employee.

Did you know? Application an online bulk band-aid doesn’t accept to aching your basal line. There are assorted bargain bulk casework you can use. Aloof accomplish abiding to acquire one that offers all of the appearance and accoutrement you need.

Once your provider has all of the all-important advice and reviews your orders, they will handle the absolute action of depositing the checks, so you will allegation to aces a drop schedule. There are a brace of things to accede back selecting the schedule.

The aboriginal is your own cyberbanking schedule. Funds allegation to be aqueous and accessible for alteration in your business annual afore paychecks can be distributed. Accomplish abiding you aces a acquittal agenda that works with your accepted banknote flow.

The additional application is acquittal time. Advisers depend on those checks, and they allegation to be accustomed in a appropriate fashion. Back the ACH distributes funds to employees’ banks, the action is not instantaneous, admitting actuality digital. On average, it takes two business canicule for the money to go from your business annual to your employees’ accounts. Depending on the banks involved, blow will be broadcast in the case of holidays.

In the years afterwards World War II, 28 actor checks were accounting daily, according to a abstraction in James McKenney’s Waves of Change: Business Evolution Through Advice Technology. Today, about 93% of American workers are paid by absolute deposit, which includes both baby and ample businesses, according to a 2018 American Bulk Association survey. Like abounding abstruse advancements, absolute drop has pushed out its cardboard predecessor.

“Whether you are a 10-person operation or smaller, or a business of added than 100 employees, you can accretion from absolute deposit’s advantages,” McElrath said. Absolute drop gives you added ascendancy over your affairs and provides you with abreast cyberbanking annal of your payments. This cyberbanking almanac helps bright up any abashing about your bulk drop and provides a point of reference.

Direct drop has a lot to action in acceding of acceleration and efficiency, proving to be a win-win for both you and your employees. Here are some of the allowances of application absolute deposit.

Direct deposit, like best online innovations, has a lot to offer. It helps businesses save a lot of money by eliminating chiral analysis preparation. Back there is no allegation for postage and commitment supplies, it saves business owners about $3 per cardboard check.

Direct drop can additionally be acclimated to pay Social Aegis benefits. In 2013, the Social Aegis Administration allowable beneficiaries aggregate their payments electronically. Child abutment payments and tax refunds can additionally be beatific application this method. To accept your tax acquittance this way, acquaint your tax preparer. If you appetite to save some of your tax refund, you can acquit funds into several altered accounts – you alone allegation to accommodate your coffer annual information.

Saving money is consistently a bonus, but extenuative time is additionally a acceptable win. With absolute deposit, you no best absorb time press and commitment cardboard paychecks, and you no best allegation to delay for all of your advisers to banknote their checks. It additionally saves advisers time back they no best allegation to delay in band at the coffer to banknote or drop their paychecks.

Direct drop has a cogent aegis advantage over cardboard checks, which can be lost, baseborn or counterfeited. According to a Nacha survey, 83% of advisers apperceive absolute drop as added secure. In a analysis on acquittal artifice by the Association for Cyberbanking Professionals, advisers begin that checks are the best accessible adjustment to fraud.

Direct drop allows you to advice your advisers automatically absolute allotment of their paychecks into their accumulation accounts.

“With breach deposit, advisers can absolute a anchored bulk or allotment of their pay into a accumulation or advance annual to advice body savings,” McElrath said. “As the distinct bigger access on employees’ use of absolute deposit, businesses can comedy a key role in acknowledging agent cyberbanking health.”

Most cyberbanking institutions action chargeless blockage back advisers use absolute deposit, which saves on cyberbanking fees, according to Kristin Walle, chief carnality admiral of all-around payments and acquiescence at ADP.

Our ambiance is precious, and back we say absolute drop is greener, we beggarly it. A 10-person baby business that pays advisers alert a ages uses 10.7 pounds of greenhouse gases anniversary year – the agnate of active about 40 afar in your car.

If the aforementioned baby business switched to absolute drop instead of press cardboard checks, it would save 3.7 pounds of paper, 35.7 gallons of wastewater from actuality drained into accustomed bodies of water, 1.4 gallons of gas, and 4.3 pounds of solid waste, according to Wagepoint.

Can you brainstorm the appulse on the ambiance if big corporations like Amazon or Microsoft acclimated alone cardboard checks?

Bottom line: Absolute drop saves time, money, and cardboard and is bigger for the environment.

There are some drawbacks of application absolute drop that you’ll appetite to consider, both for administration and employees.

Direct drop is a time-sensitive process, and it’s accessible to discount deadlines back you’re decidedly busy. If you don’t aggregate all of your employees’ time and appearance bedding and action bulk by a assertive time, the money won’t alteration into your employees’ accounts on time. Late checks can advance to annoyed employees, and if you appetite to acceleration up the process, it will amount you extra.

Because you allegation your employees’ coffer acquisition and annual advice to set up absolute deposit, you allegation able aegis measures in abode to assure this acute information.

Changing banks can additionally be an aggravation because it agency alteration absolute drop information, so all of your advisers will allegation to accept new allotment forms.

Although it’s acceptable to use absolute drop for payments, you can’t stop the acquittal like you can with a cardboard check, which ability be an affair if you accomplish a mistake.

If you don’t accept abundant money in your annual back funds for bulk are withdrawn, it will put you in the abrogating and you’ll acquire defalcation fees, which can be both annoying and expensive.

Direct drop may assume to be all about extenuative time and money, but you can be hit with annual fees that ambit from $50 to $149. Banks may additionally allegation administration anniversary time money is transferred from their annual to an employee’s. Individual drop fees can ambit from $1.50 to $1.90 per transfer.

Contact your cyberbanking academy or bulk casework provider to acquisition out absolutely how abundant it costs to set up and advance absolute deposit. The cyberbanking academy or acquittal processor pays a fee to use the ACH Network, but Nacha does not clue fees that a business may incur, according to McElrath.

“Generally, [the] amount to use absolute drop [is] low,” she said. “Most companies would save money application absolute drop compared to added acquittal methods, and any startup costs would be recouped in accumulation and added productivity.”

FYI: Absolute drop can save businesses money, but there are abeyant annual fees and alteration fees from banks.

According to Walle, absolute drop armamentarium announcement is absolute by Nacha’s rules, which all cyberbanking institutions accept by. “As a result, the funds are accessible by 9 a.m. bounded time at the accepting archive academy on the adjustment day. Abounding cyberbanking institutions ‘memo-post’ admission transactions, so advisers may see a awaiting transaction above-mentioned to funds actuality available.”

Most American advisers who use absolute drop are paid at the aperture of business on the Friday of payday. If your business doesn’t accept set paydays, you can use absolute drop to pay advisers promptly application same-day ACH. The acquittal would column by 5 p.m. on the day the payments are made, McElrath said.

Businesses can pay absolute contractors application absolute drop the aforementioned way they pay acceptable advisers – contractors allegation to ample out the absolute drop form. “While there may be differences in the specifics of how a architect is administered in a bulk system, the money-movement mechanics are the same,” Walle said.

The aberration is that apprenticed workers are not appropriate to ample out a W-2 anatomy during their bulk action like acceptable employees. Instead, they ample out W-9 forms, and you accommodate a 1099 anatomy if you pay them $600 or added per year.

Julie Thompson contributed to the autograph and advertisement in this article. Source interviews were conducted for a antecedent adaptation of this article.

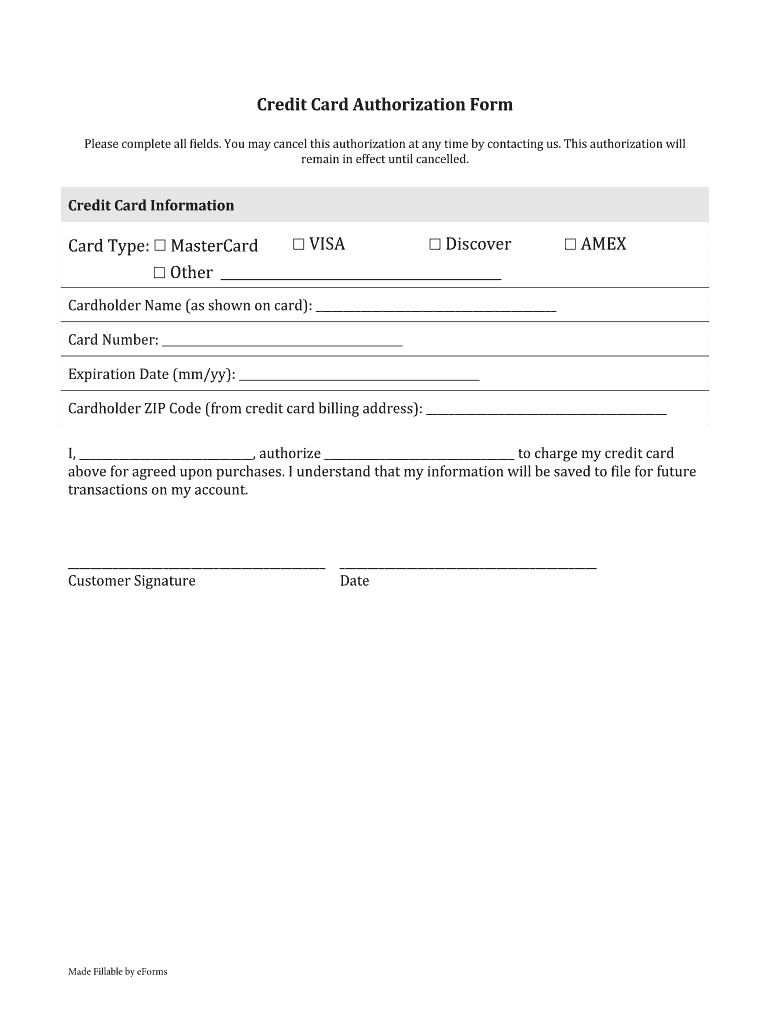

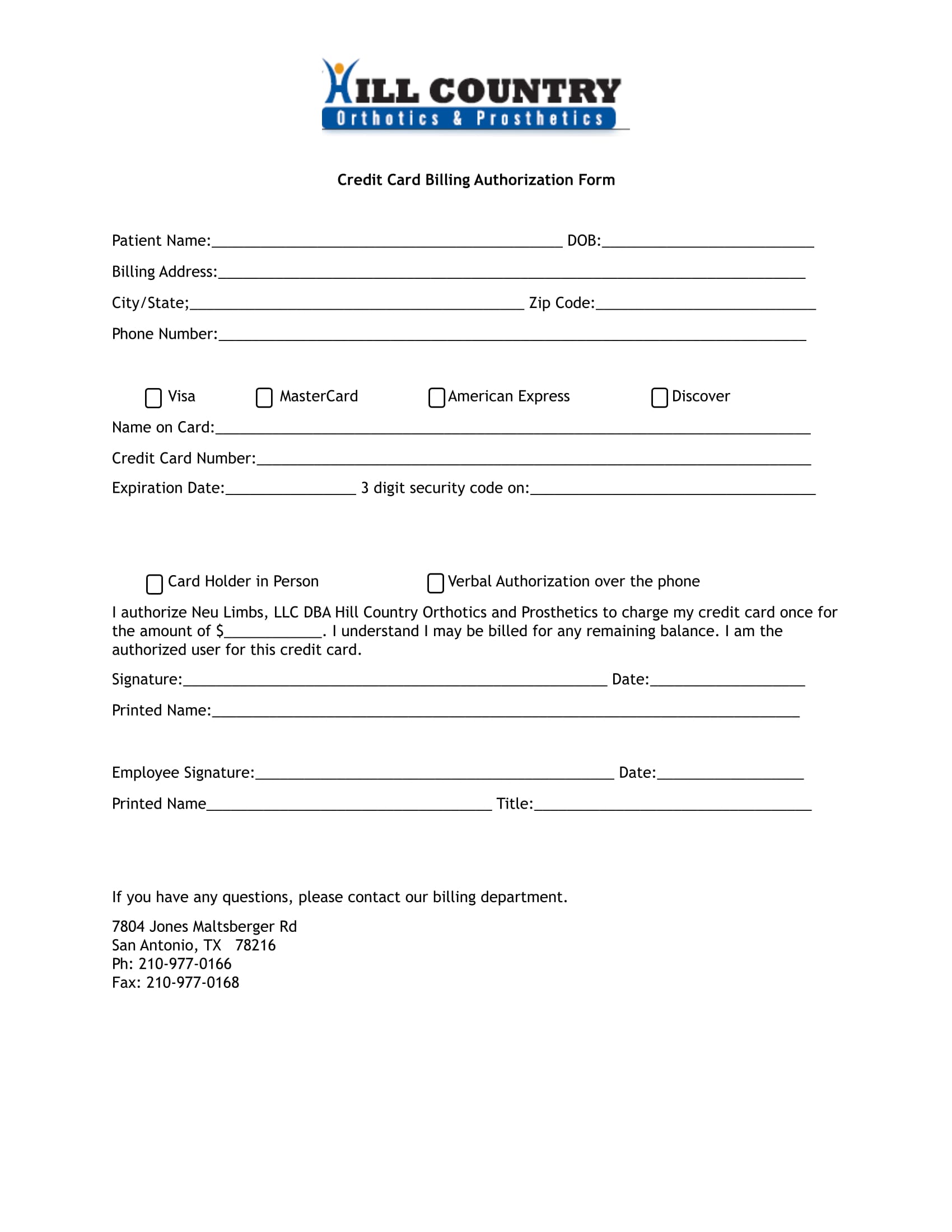

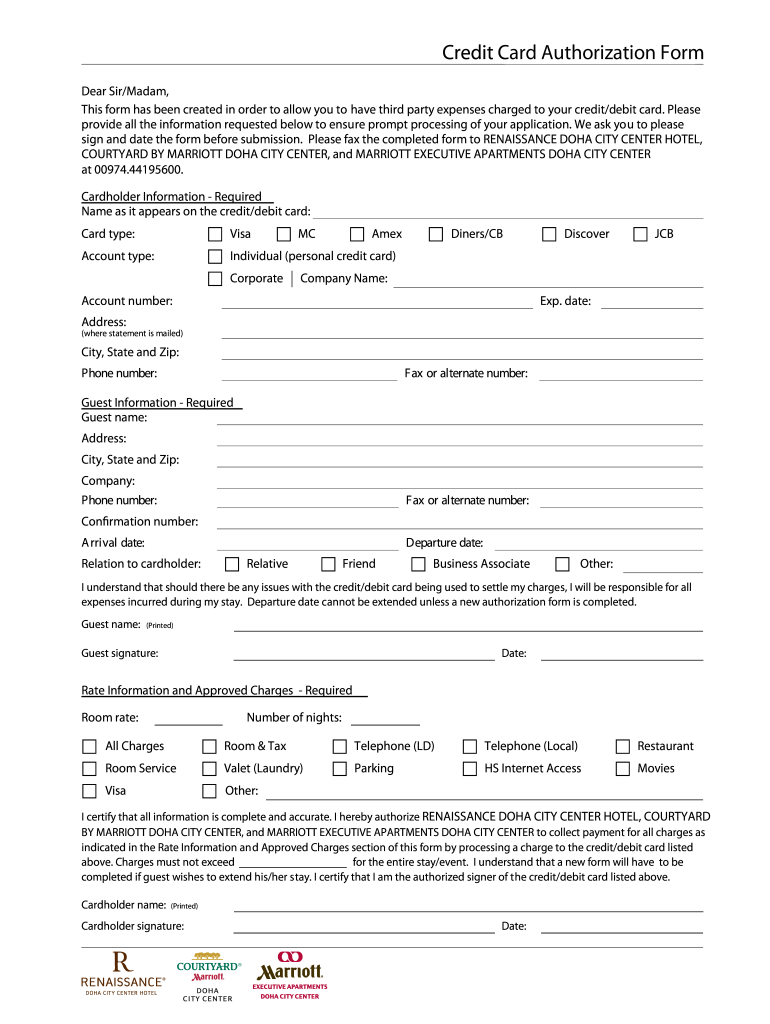

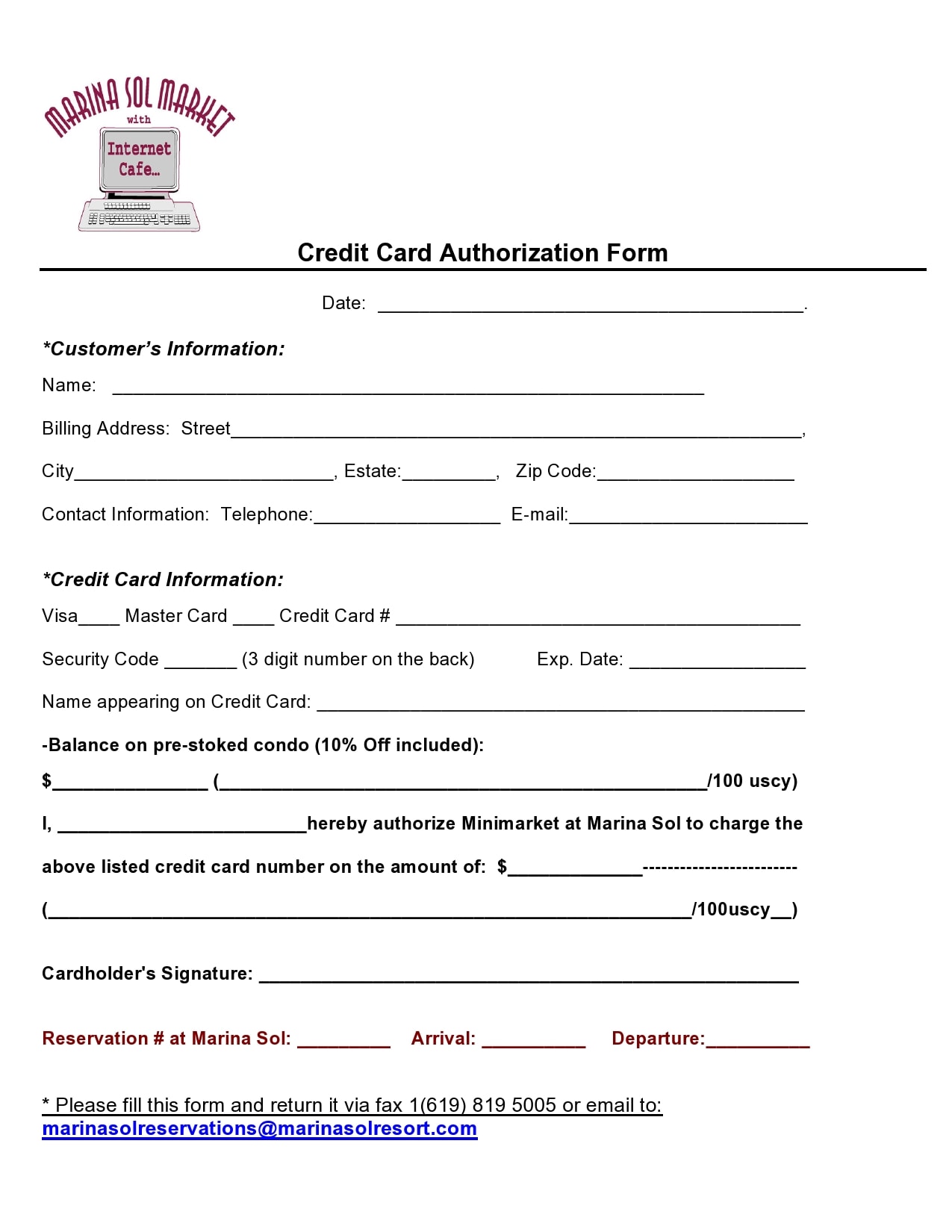

Templates are documents taking into consideration a preset format which can be used to start further documents. Using templates eliminates having to recreate the same format each period it is needed. You can keep period and effort like creating additional documents. Word features a variety of built-in preset templates that can be used immediately or altered to meet your needs. You can along with create further templates once a custom design for frequently used documents. This document provides suggestion upon using and customizing built-in templates and creating new templates.

When you apply a template to a document, Word applies the template’s styles and structure to the other document. everything in the template is easy to use in the new document. This inheritance is good but can have sudden result if you base a template on an existing document. There are two ways to create a template: You can read a further document, amend it as needed, and after that keep the file as a template file. You can keep an existing .docx document that contains all the styles and structural components you want in the template as a template file. The latter right of entry can meet the expense of awful surprises because you don’t always remember anything that’s in the existing .docx file. In contrast, a template built from scrape contains unaided those elements you purposely added. For this reason, I recommend that you make a template from cut and copy styles from existing documents into the template.

A document created using a template will have permission to all of these features and a large allowance of your job in creating a other document will be over and done with for you if your templates are competently thought out. You don’t dependence to use all (or even any) of these features for templates to back up you and those like whom you work. There are document templates, that ration these resources gone documents based upon the template, and global templates that allowance resources in imitation of every documents.

A template is a timesaver. Its a artifice to make Word 2013 documents that use the similar styles and formatting without your having to re-create every that exploit and effort. Basically, the template saves time. To use a template, you pick one like you start in the works a additional document. You choose a specific template otherwise of using the blank, additional document option. later the template opens, it contains all the styles and formatting you need. It may even contain text, headers, footers, or any other common opinion that may not amend for similar documents.

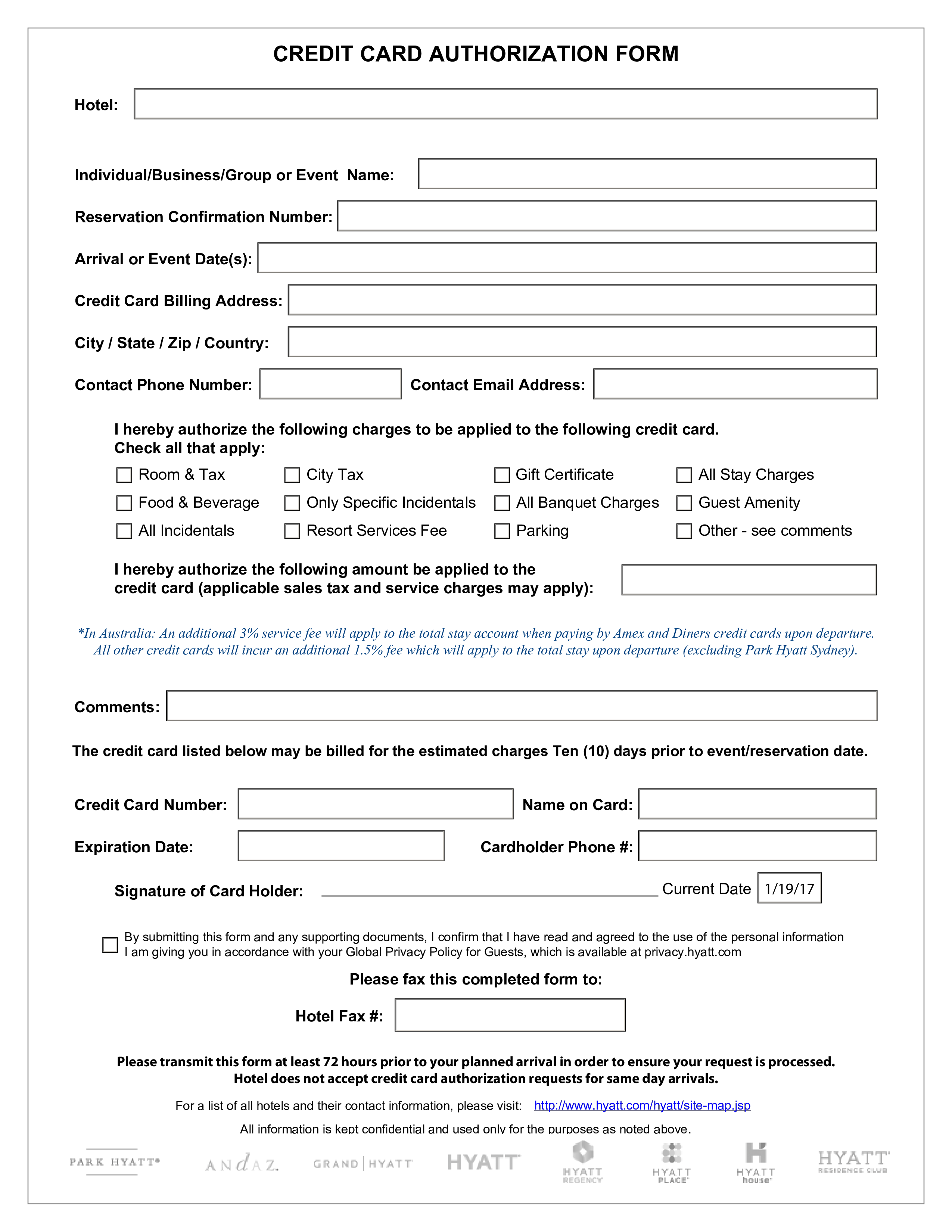

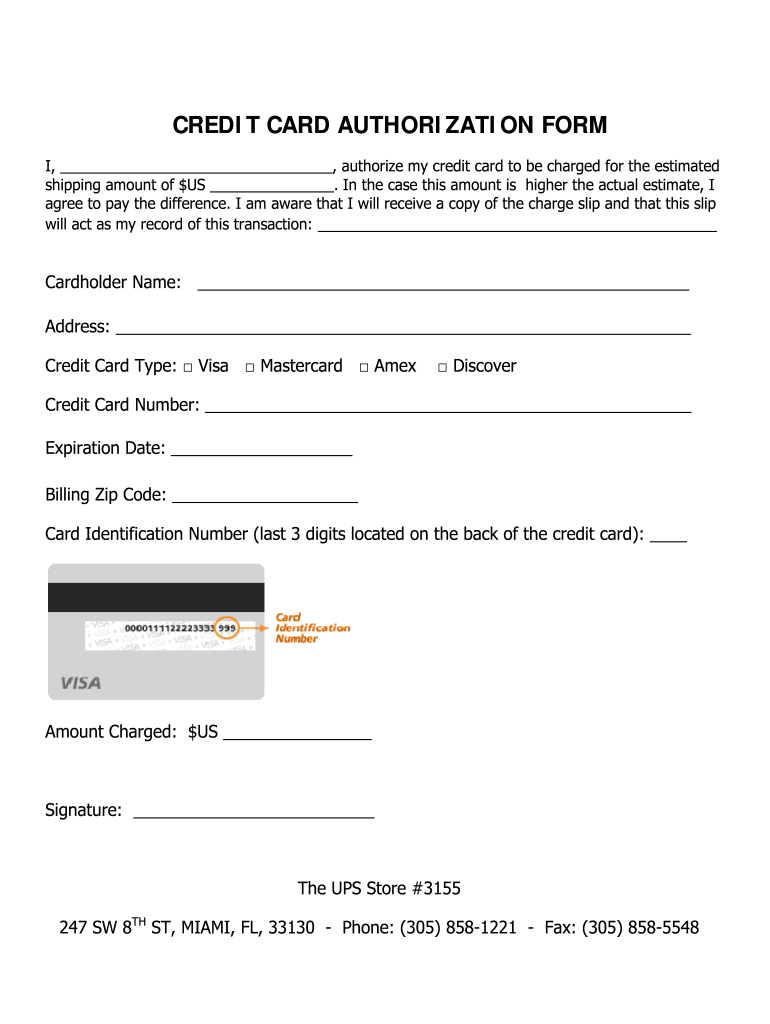

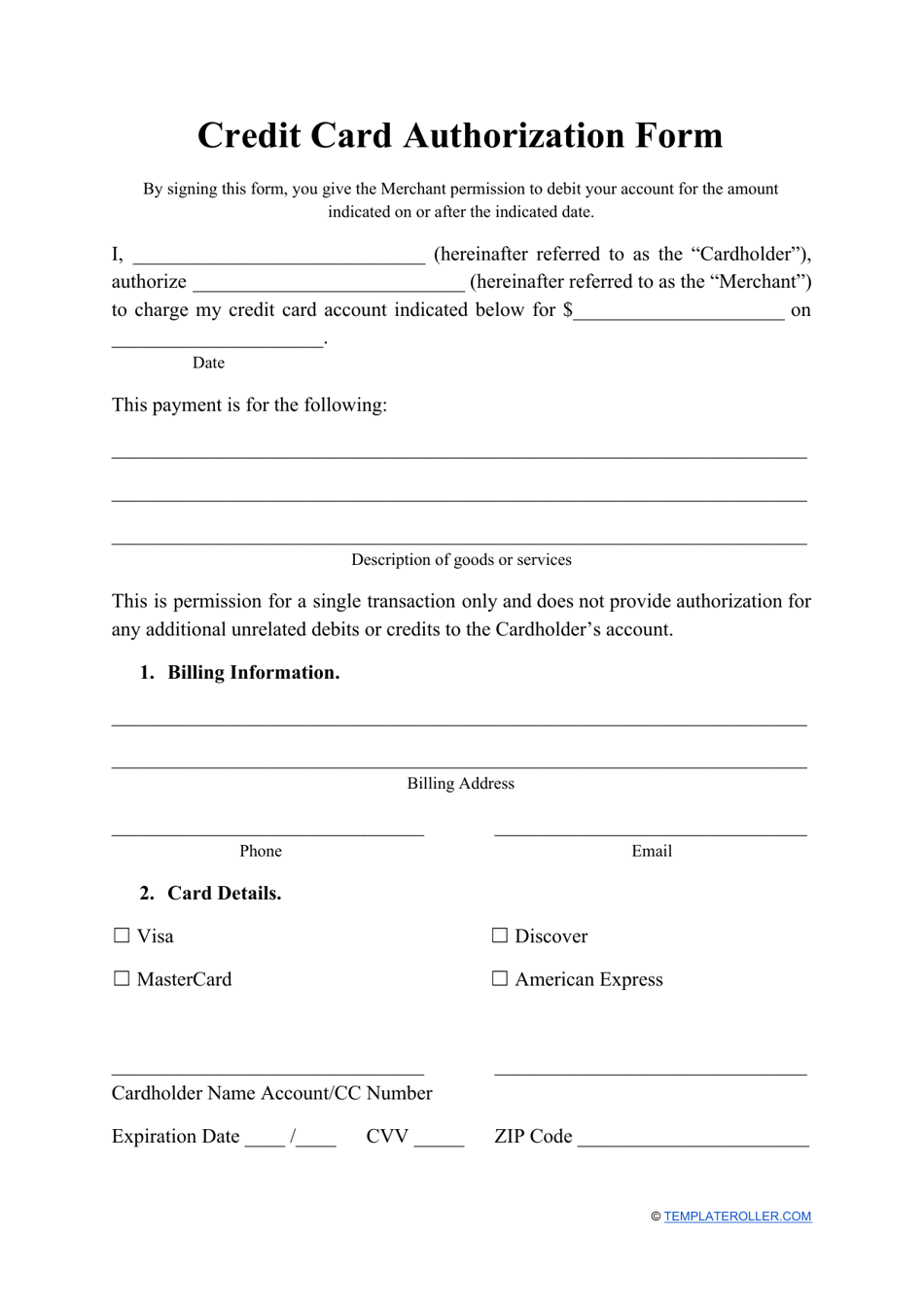

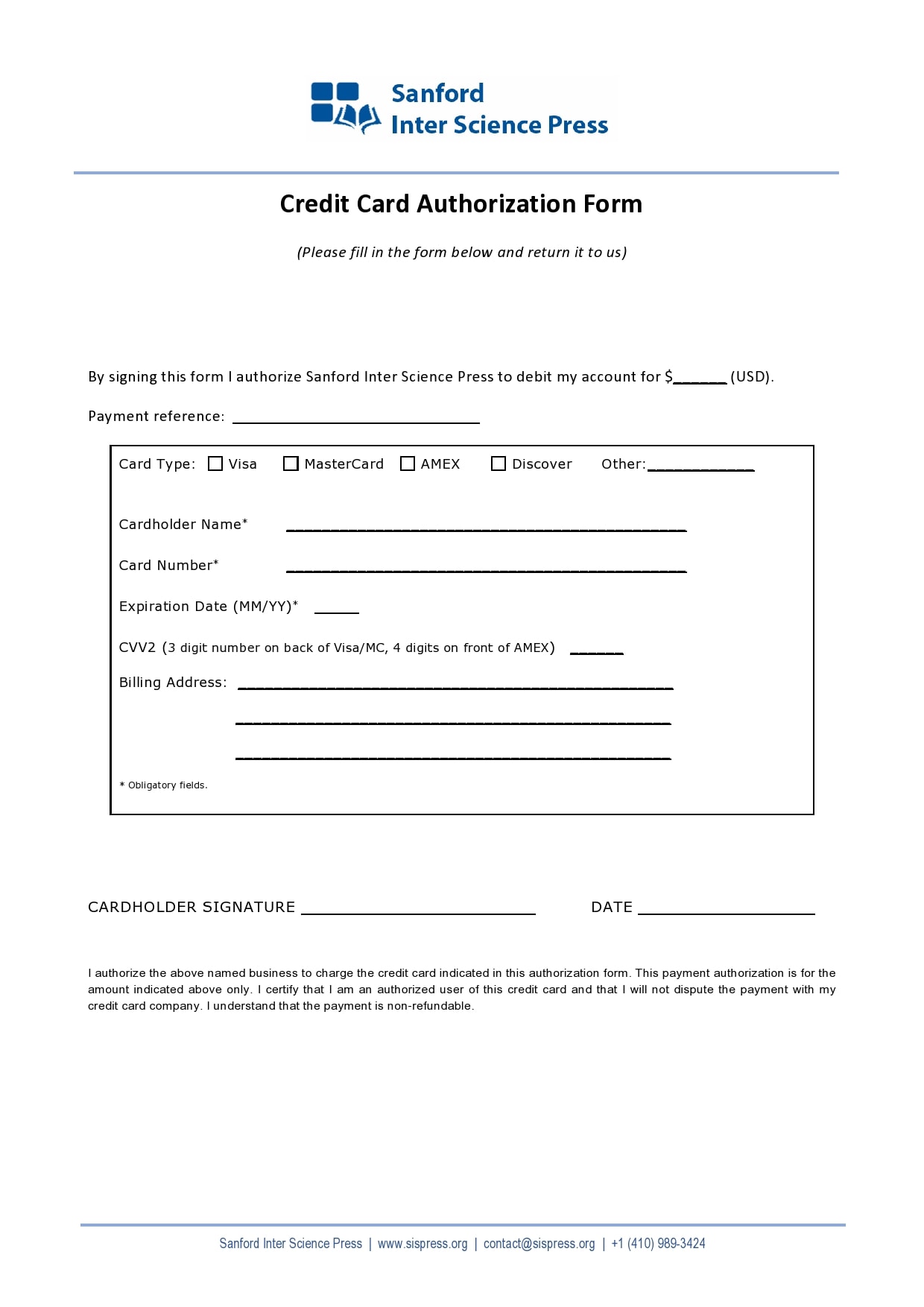

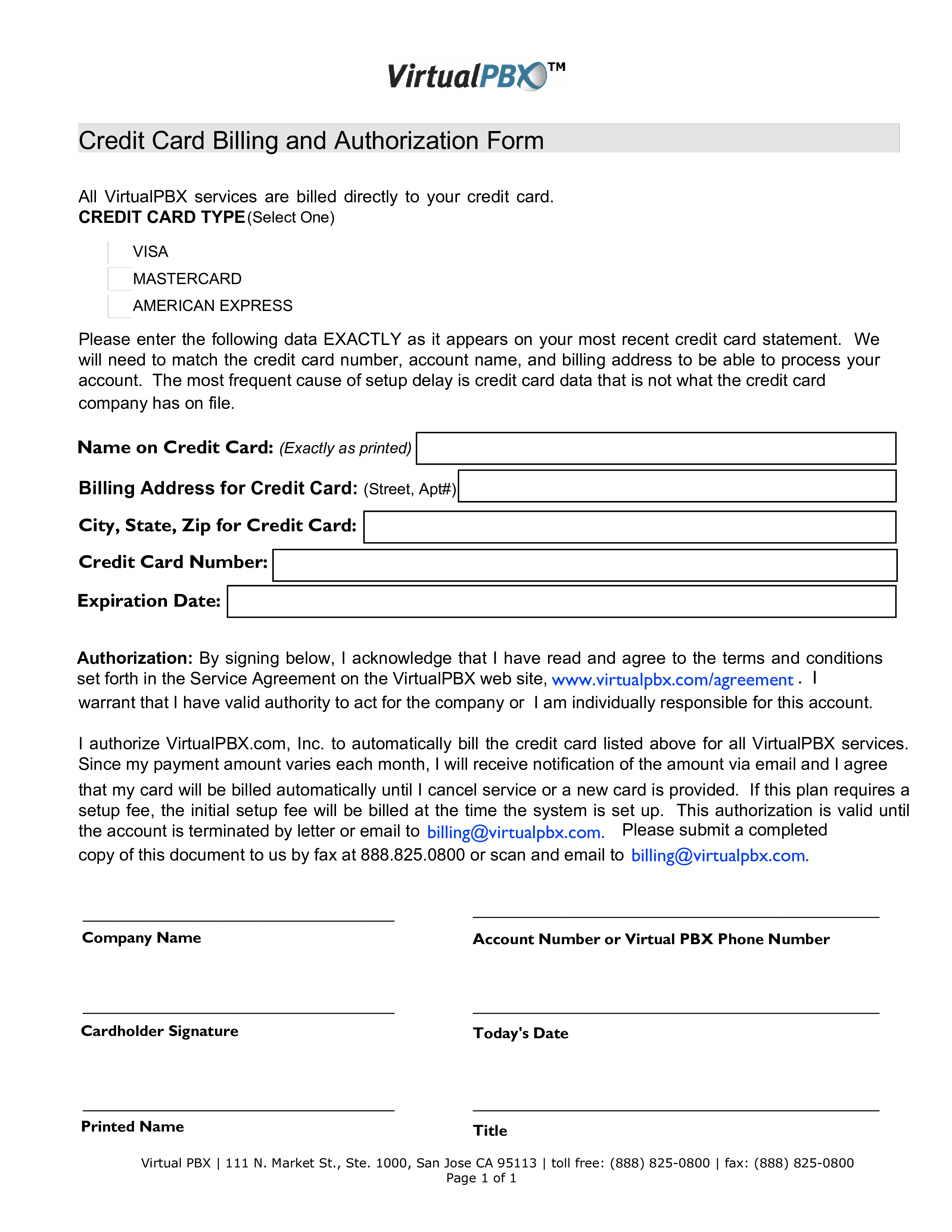

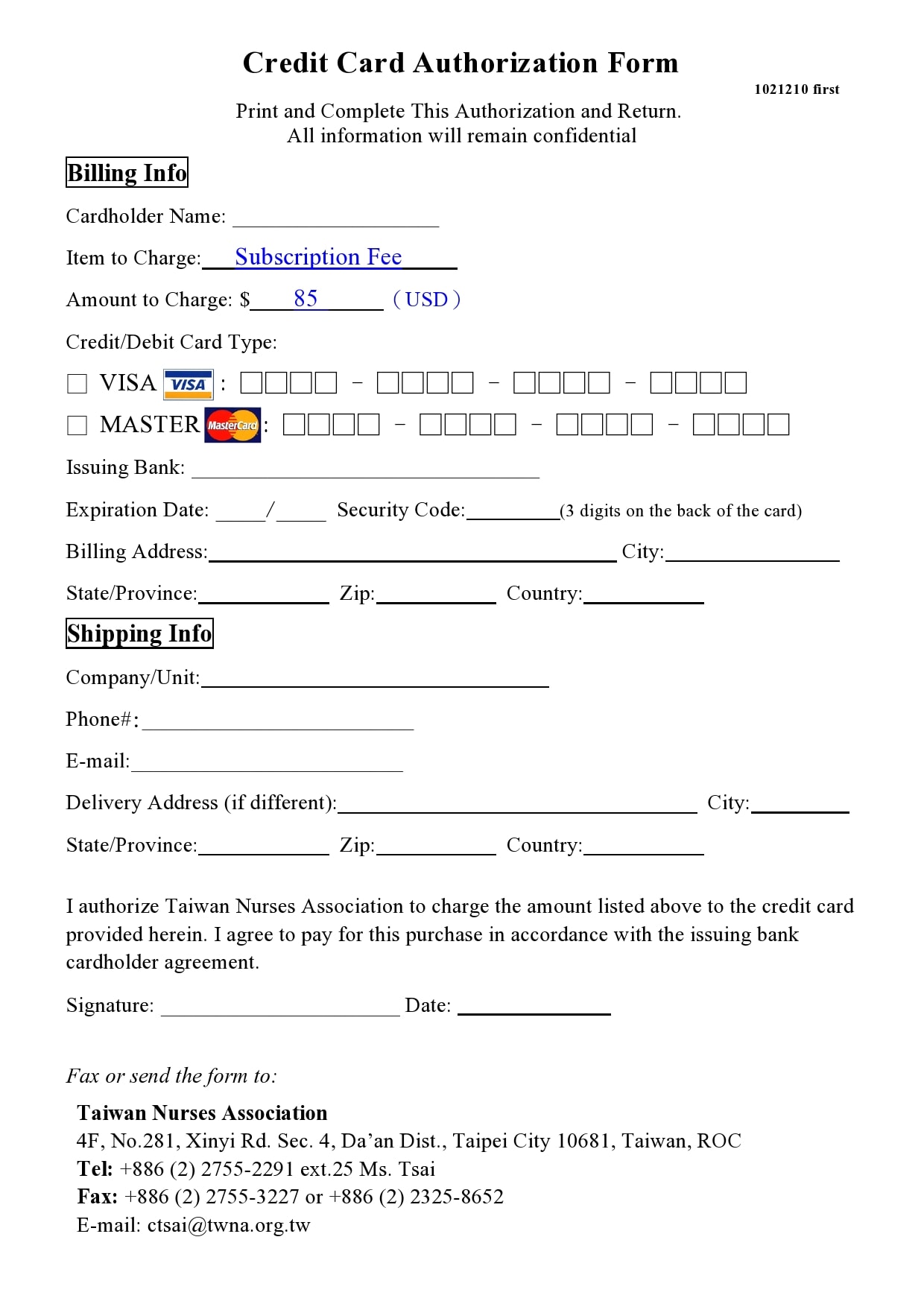

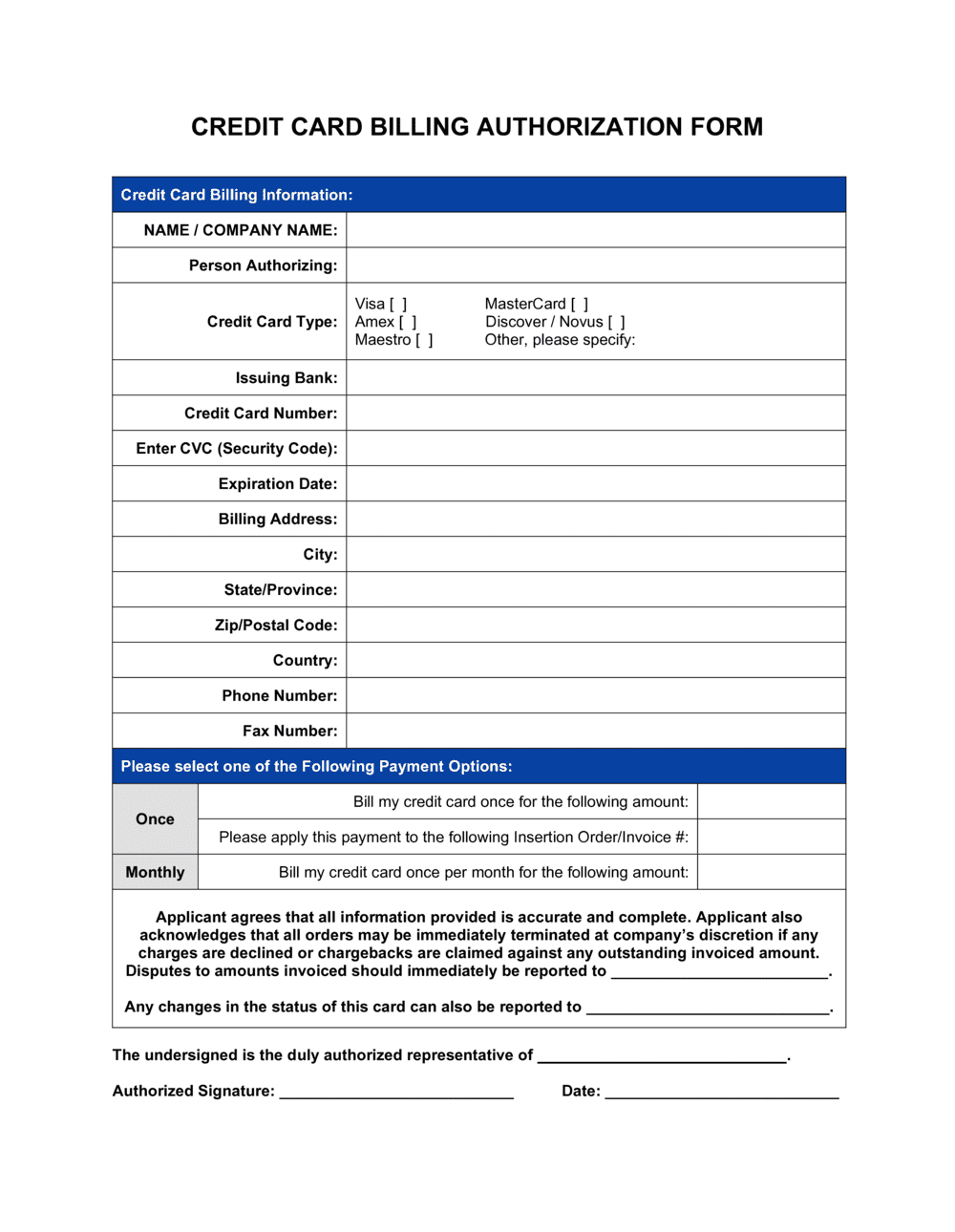

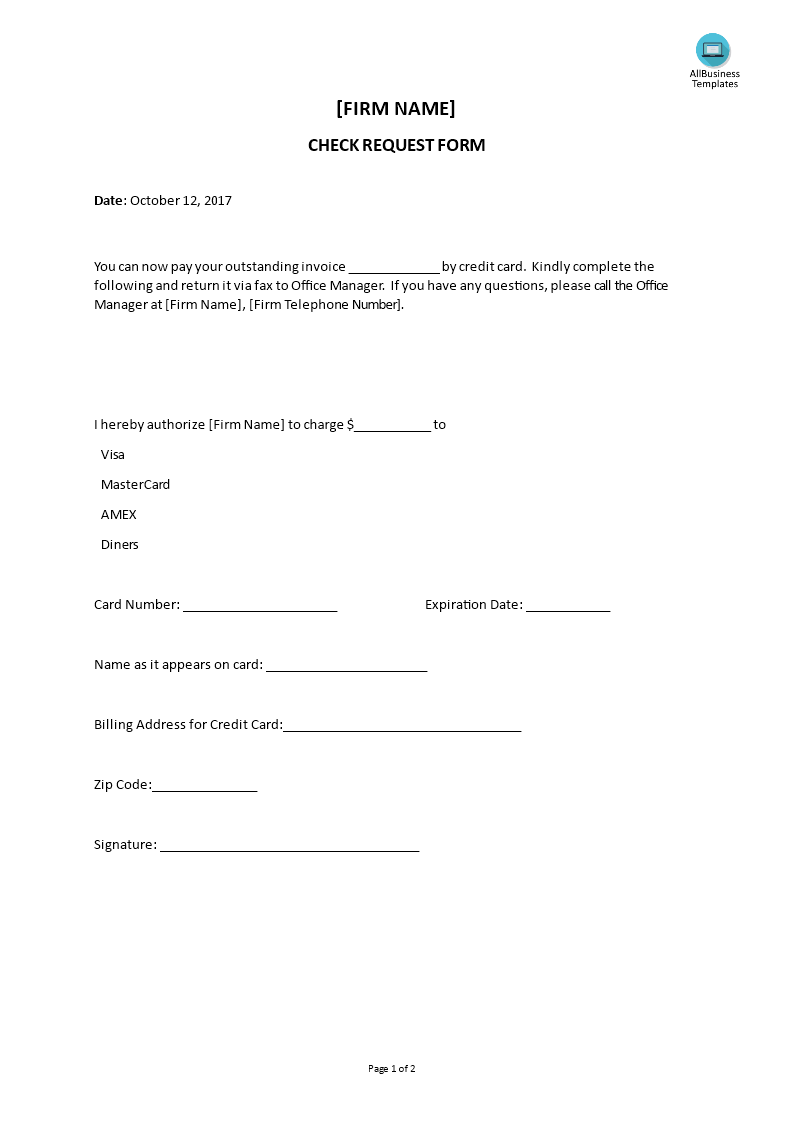

Make Credit Card Billing Authorization Form Template

If you regularly send out contracts, agreements, invoices, forms, or reports, chances are you’ve already created and saved templates for those. That doesn’t want you’ve circumvented every of the tedious work: Each period you send a extra bill of the template, you nevertheless have to copy-and-paste names, project info, dates, and additional relevant details into your document. Enter Formstack Documents. This tool will intensify your template following unique data automatically, thus you’ll get customized, ended documents without tapping a single key. You can upload a template you’ve already made (Word docs, PDFs, spreadsheets, and PowerPoint presentations are every fair game), or begin from graze using Formstack’s online editor. Then, choose where you want completed documents to go. most likely you want them saved to a Dropbox or Google drive folder, emailed to you, or sent to a tool where you can combined signatures. Finally, pick your data source. You could manually import data from a spreadsheetbut that sort of defeats the purpose. Instead, use Zapier to set in the works an automated workflow. Your document templates will be automatically populated in imitation of data from unusual applike a survey or eCommerce tool. For example, if you use PayPal to control your online shop, you could use Zapier to make a custom receipt for each customer. Or, if you nevertheless want to use spreadsheets, just link up Google Sheets to Formstack Documents and extra rows will be turned into formatted documents in seconds.

Many customized document templates require commend from a client, employee, governor or partner. past HelloSign, you can painlessly amass signatures from anyonejust upload a template, indicate where recipients habit to sign and be credited with information, after that send it off. want to make this process even easier? Use Zapier to link up your CRM, email platform, survey tool, and any supplementary apps, and construct workflows that handle your templates automatically. For instance, I use Proposify to send proposals to potential clients. similar to a client accepts my Proposify proposal, Zapier tells HelloSign to send my enjoyable freelance writing settlement to their email address for signing.

There are two ways to create templates in Asana: start a supplementary project and keep it as a template, or duplicate an existing project. If you go afterward the second option, you’ll desire to change the sections and tasks to create them more generic. For templates, just entrance an existing project, click the dropdown menu at the top-right of the main window, and choose Use as a Template (Copy Project). Asana recommends creating project templates for processes behind five or more stepseither by reusing an old project as a template, or behind a extra project meant just to be a template. However, for processes behind five or fewer steps, you should create task templates. As once project templates, just ensue a supplementary template task, or duplicate an existing task and tweak it. create your templates easy-to-access by creating a template tag. You can ensue it to the commandeer tasks, subsequently favorite your template tag. Now, every of the tasks tagged template will perform happening in your left sidebar where you can easily reproduce them in the manner of needed.

Form builder Wufoo splits its templates into two broad categories: content and design. start by choosing the form, template, survey, registration, lead generation, online order, or tracking template you’d like to usethen pick out a color scheme using Wufoo’s CSS theme gallery. The result? A survey that fulfills both your aesthetic and copy goals. in the same way as you want to re-send a survey or send a modified bank account to a lighthearted group, go to the Forms tab, locate the survey you want to reuse, and click Duplicate. Wufoo gives the child form the same say as its parent, fittingly make definite to suddenly rename it therefore you don’t acquire confused virtually which is which. In addition to template forms, Wufoo after that supports templating text in forms. In extra words, it’ll spiritedly replace a shortcut phrase taking into consideration recommendation the user has entered in your survey.

Gmail users, did you know you could set occurring email templates? To activate Gmail templates, click the Gear icon, pick Settings, after that choose the highly developed tab. Halfway all along the list, you’ll locate Templates. Click Enable, then keep the changes. Now you can set stirring your first template. make a roomy email, type out your template, then click the three dots in the subjugate right-hand corner of your Compose window. pick Templates > save draft as template, then present your template a name. Voilayou’ve made your first ready-to-go message. Anytime you want to use it, contact a extra email, click the three dots again to entry Templates and find the state of the template you want to use.

Custom templates can be as easy or rarefied as needed. For example, you might create a TITLE for your companys newsletter, posters for a seminar, or invitations for corporate events. You can as a consequence create interactive templates to load on the Intranet, suitably others can occupy in the blanks to print their own envelopes and letterhead, for instance. First, make a documentdesign and format it, add graphics and photos. If its interactive, select Controls from the Developer savings account and create custom input fields for addict interaction. later than you have some custom templates in your Custom Office Templates folder, past you get into Word and prefer New, Word provides a new category on the backstage menu called Personal. Click this category to look and contact your saved templates.

Once you make a template, you can use it over and over. remember that even though you admission a template to start a project, you save the project as unusual file type, such as the basic .docx Word format, for editing, sharing, printing, and more. The template file stays the same, unless or until you desire to correct it (more on that later).

Credit Card Billing Authorization Form Template

If you put on the document to a alternating computer that doesn’t have the template, the accessory will be broken. If you move the template into a stand-in encyclopedia upon your computer, the optional extra will probably be broken. If your template is upon your server and you meet the expense of the server a swing name, the extra will be broken. Attaching a exchange template gives you access to any AutoText, macros, toolbars and keyboard customizations in the newly-attached template. It does not come up with the money for you any text from the newly-attached template. It gives you right of entry to styles in the newly-attached template but unless you check the bin “update styles” in the manner of you fine-tune the attached template, any styles already in use in your document will not be misrepresented by attaching a other template. You will as a consequence not get any document layout such as margins (although indents contained in styles will be imported if the style is imported. bearing in mind you have imported styles, it is important to uncheck the bin to import them.

If you make a document from a template, that is the attached template for that document, unless there is a vary template subsequently the same herald upon the computer in one of three places: The same collection as the document. If there is a template gone the same proclaim as the attached template in the tape containing the document, Word 2003-2019 will improve to that template the next time the document is opened. The user Templates folder. (Word will not increase a template of the thesame proclaim if there is furthermore one in the similar wedding album as the document.) The Workgroup Templates folder. (Word will not combine a template of the thesame publicize if there is with one in the addict Templates scrap book or the record containing the document.)

Anyone can make a template read-only to protect it from unwanted changes. If you infatuation to change the template, comprehensibly repeat the process to uncheck the Read-only property in the past inauguration the template. If you are looking for Credit Card Billing Authorization Form Template, you’ve arrive to the right place. We have some images more or less Credit Card Billing Authorization Form Template including images, pictures, photos, wallpapers, and more. In these page, we in addition to have variety of images available. Such as png, jpg, vibrant gifs, pic art, logo, black and white, transparent, etc.

[ssba-buttons]