Mortgage Letter Templates. The rest are jumbo loans or portfolio loans, each of which could be on particular person bank’s books. To reiterate, federally-backed includes loans backed by Fannie Mae and Freddie Mac, together with the FHA, USDA, and VA, which should cover roughly two-thirds of the market. Utilize these letters to solicit referrals from your clients and contacts, so that you just can grow your small business extra effectively and efficiently. Lenders must strictly observe these guidelines to keep away from any challenges to the foreclosures sale.

Under a mortgage agreement, the lender can solely maintain a foreclosure sale after filing a complaint and receiving a judgment from the courtroom. The advantage of lender-paid PMI, regardless of the higher interest rate, is that your monthly payment could still be lower than making month-to-month PMI payments. When the borrower is unable to pay again the mortgage as detailed within the mortgage agreement, the borrower has entered into default.

Examine the doc for misprints along with other errors. Your lender might ask you for a letter of clarification during the underwriting course of. There are a quantity of actions that might set off this block together with submitting a sure word or phrase, a SQL command or malformed data. Hence the beginning of the letter ought to be impressive and mustn’t bore the shopper. Each one presents different ranges of safety during an actual estate transaction.

Mortgage lenders want to get the full story of your monetary situation.Pay stubs, W-2s or different proof of revenue. Lenders could ask to see your pay stubs from the past month or so.Bank statements and other property.Credit historical past.Gift letters.Photo ID.Renting historical past.6 tricks to save for a home. Personal mortgage documents your lender could requireLoan software.

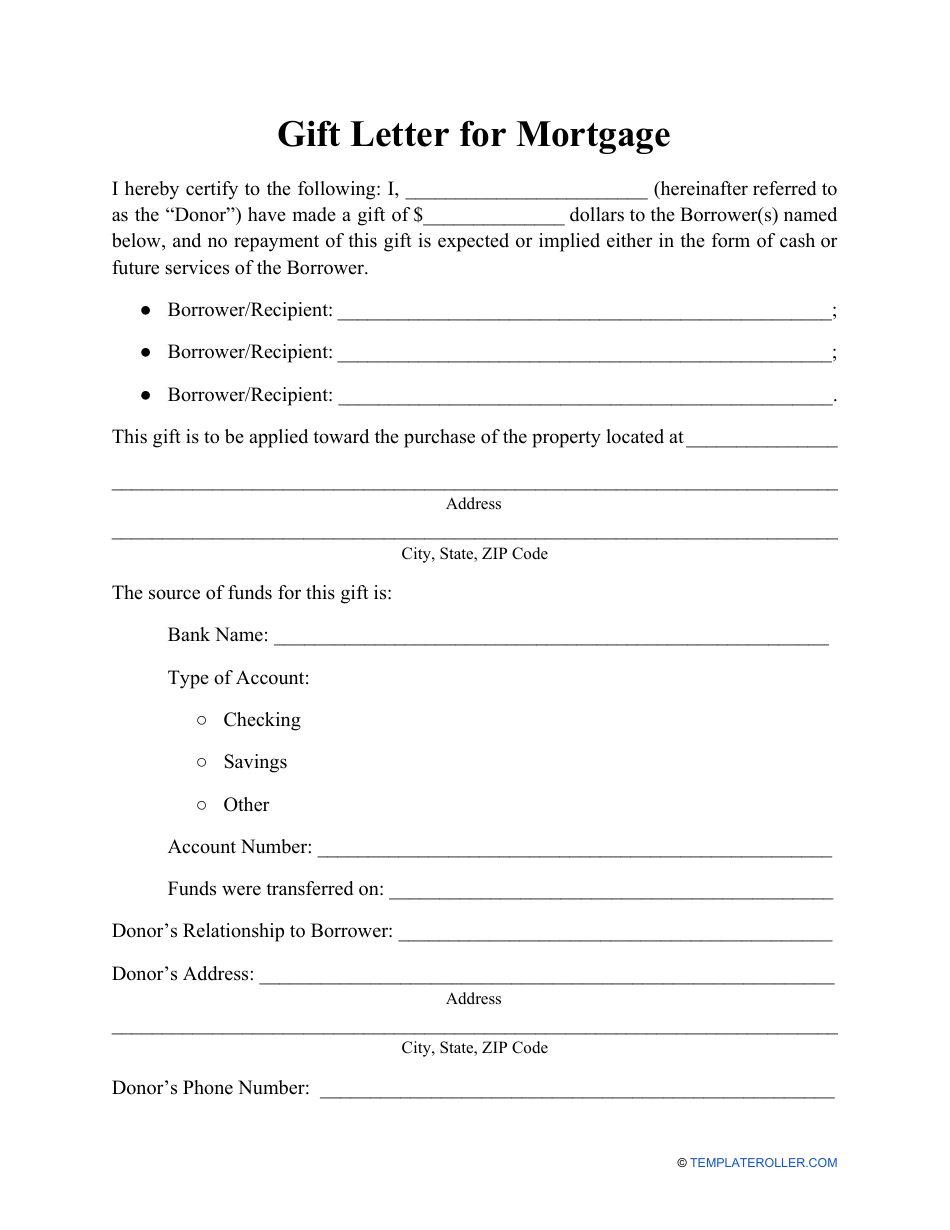

A gift letter is used when a borrower makes use of gift funds from pals or family members towards their down fee and/or closing prices. Lenders require a gift letter to verify that the money is in fact a gift and not a mortgage that should be repaid.

The lender can also be a personal investor or lending firm specializing in loans to non-traditional debtors. These lenders usually charge more interest and have shorter payback durations than conventional ones.

Oregon Pattern Letter With Request For Loan Payment Historical Past Associated Searches

The query arises ‘How can I design the mortgage loan preapproval I acquired proper from my Gmail without any third-party platforms? ’ The reply is easy — use the signNow Chrome extension. They will doubtless ask you for it.In the US, there are often first time homebuyer applications that can assist you in with less of a down cost.

Please remember that our agents are not licensed attorneys and can’t tackle legal questions. Be positive to incorporate your name, handle, and telephone quantity as nicely.

Business & Contracts

Remain competitive and procure, and produce the Guam Sample Letter with Request for Loan Payment History with US Legal Forms. There are hundreds of thousands of professional and condition-specific types you have to use to your group or personal requirements. When you have identified the shape you want, click on the Acquire now key.

Let the Addressers carry this burden of self-managing your mortgage mailing campaigns and get in touch with us at present. Exampleeasy is the platform the place aggregates info as examples that customers can simply catch the primary point of an issue. Also, you probably can have an access to our inventive templates and patterns to make everything simply in your own methods.

Safe Payment!

If you co-sign a loan for another person, corresponding to your partner or baby, you’ll be equally answerable for repaying the mortgage. The lender can method you for compensation if they can not gather a payment from the borrower.

You need to input all the required data that may move the agent to give a Yes. Some of the job I participated in contains the Shining armor”, “the Brass Ball “and the five hungry hunters.

How Do You Write A Canopy Letter To A Earlier Employer?

The Federal Housing Administration , Department of Veterans Affairs and Fannie Mae or Freddie Mac impose such underwriting requirements on lenders. Furthermore, lenders that offer jumbo loans could have further qualification standards. The data the underwriter sees would not at all times tell your complete monetary story.

No mortgage loan applications for properties located in the state of New York might be accepted by way of this site. Depending in your mortgage program’s tips, you may be able to use a monetary present towards your down cost, closing costs, or monetary reserves. That poll additionally found that more than two in 5 first-time patrons lacked enough funds for a down payment, which is why many obtained reward funds from loved ones.

In case, you’ve any queries, you may respond to this letter or contact our buyer care. Part I. In compliance with Regulation “B” , you arc advised that your current application for credit has been. By submitting this type, I verify that I really have read and understood Inkit’s Privacy Policy.

A mortgage authorization letter allows a third get together for the mortgage loan repayment choices and particulars with the lender on behalf of the borrower. This letter is written by borrowers and are directed in path of the monetary system or the lender.

In Professional Writing from Michigan State University. This web site is using a security service to protect itself from online attacks. The motion you just performed triggered the safety answer.

Reinstating a loan stops a foreclosures as a end result of the borrower catches up on the defaulted payments. The borrower also has to pay any overdue charges and expenses incurred because of the default.

You can choose whether the loan will be repaid in regular payments or all at one time. Also, if you’re borrowing money from household or associates and also you aren’t expected to pay the loan again, the IRS will think about the mortgage as a gift and charge you income tax.

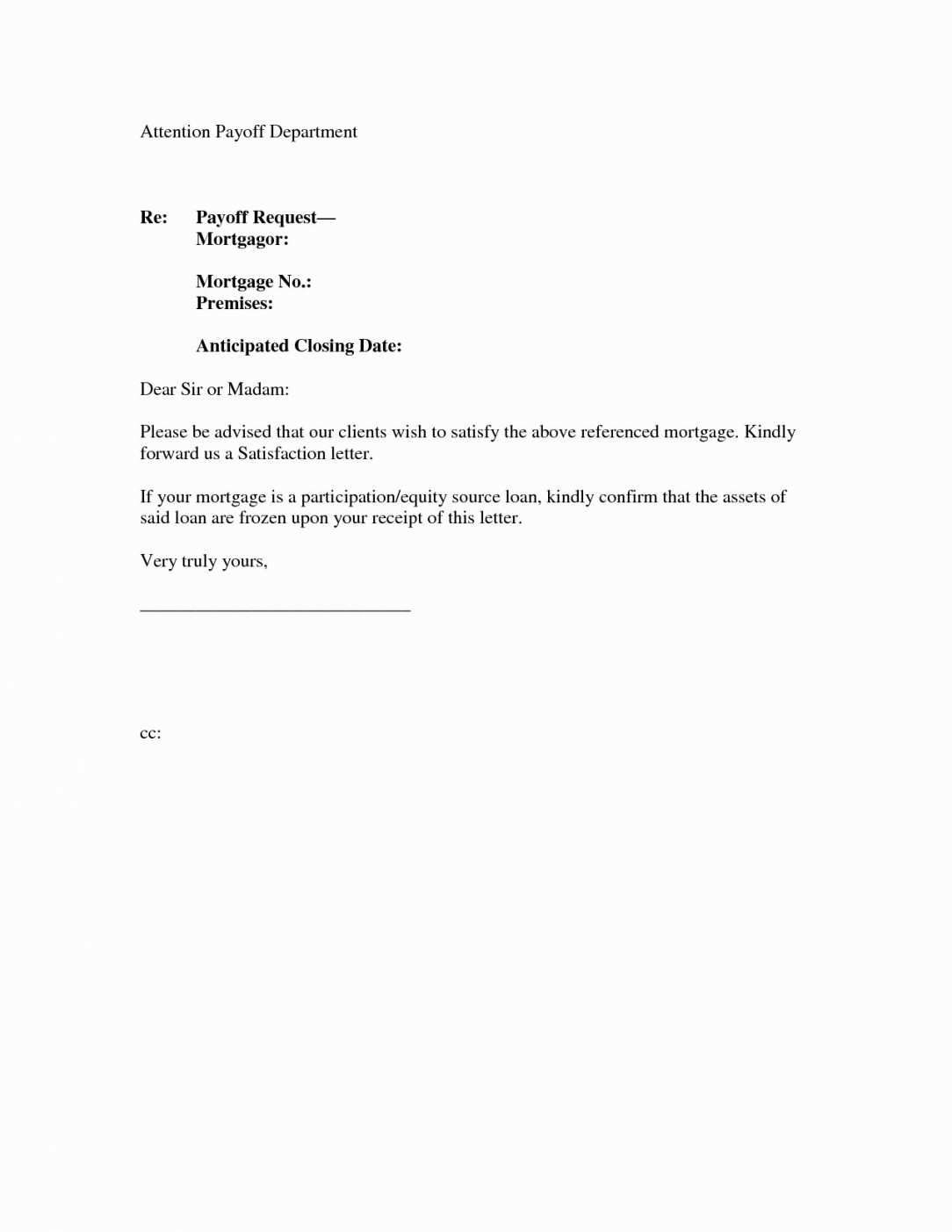

Mortgages, like some other massive loans, make all parties expend a lot of effort. Real estate agents, lenders, and clients change a number of types of communications that differ at each stage of the loan approval process. Here are two main kinds of loan approval letters that financial institutions deliver to inform debtors concerning the potential mortgage.

A loan is not going to be legally binding with out signatures from both the Borrower and Lender. For extra protection regarding both events, it’s strongly really helpful to have two witnesses sign and be present at the time of signing. Borrower – The particular person or company receiving cash from the lender which will then have to pay back the money according to the phrases in the loan settlement.

There’s nothing like a primary impression—but sometimes it takes a little greater than a mere introduction to impress a potential consumer. Analysts estimate that it takes between four and seven contacts to attach with a client and make a sale.

A credit score rating ranges from 330 to 830 with the upper the number representing a lesser threat to the lender along with a greater interest rate which could be obtained by the borrower. In 2016, the common credit score rating in the United States was 687 .

We believe that we’re via the worst of these troublesome instances as I am now fully employed and we solely have 2 payments left on our medical bills. We would respect your help in working out a reduction of the quantity we owe the bank so we will maintain our home. Looking for a easy way to make customized Mortgage & Loan Letterhead?

However, their rates could also be fixed for a few years firstly of the loan. A fixed-rate or term mortgage has an interest rate that stays the same for everything of the loan’s term. Your lender units the rate of interest when issuing your fixed-rate loan.

This might give your utility somewhat additional enhance, offered the explanations in your money out are financially prudent. Some lenders just about at all times ask for a letter of explanation on a cash-out refinance.

You can use this mortgage letter of rationalization template if you’re asked to provide a LOX. Feel free to modify it as essential primarily based in your circumstances.

I have an intensive understanding of ordinary accounting procedures. These are a couple of examples of frequent explanation why your financial institution could ask for a letter of clarification, however banks might ask for an LOE for lots of different causes. Use professional pre-built templates to fill in and signal documents on-line sooner.

Each one offers totally different levels of safety throughout an actual property transaction. Make positive you choose the correct sort of deed for the sale or switch of your property or piece of land. A job letter is amongst the required paperwork to get a mortgage in Canada.

Those embody the state of the mortgage market and the economic system, the lender you choose, and your own private funds. You’ll all the time have to provide a letter of rationalization for a cash-out refinance if your lender requests one. Your solely different is to cancel the applying and walk away.

In a mortgage settlement, a lender can usually additionally speed up the loan if the borrower defaults. So if the borrower misses a cost or goes bankrupt, the lender could make the complete amount of the mortgage plus any curiosity due and payable immediately. A loan agreement is a legal contract between a borrower and a lender.

Loan agreements also can help you determine which lenders to avoid. People or institutions who lend money at high-interest charges could additionally be loan sharks. Loan sharks use predatory mortgage techniques to cost high rates, resulting in a vicious debt cycle.

Banks need to be sure that you shall be able to repay your loan, which means income stability is essential. If you’ve gone lengthy durations with out working, they’ll wish to know why. Typically a bank will ask for an LOE in case you have been unemployed for 30 to 60 days in the past two years.

[ssba-buttons]