Wednesday, February 2, 2022

The 2022 proxy division will abide to be afflicted by the aftershocks of the COVID-19 pandemic, and will be predominantly shaped by the battleground challenge of the 2021 proxy season, area ESG affairs confused from anarchistic to the mainstream, and women captivated a historic bulk of lath seats of the Russell 3000 companies. Companies should abide to assay and ensure acquiescence with the addition of Regulation S-K, Nasdaq’s lath assortment aphorism (if applicable), and abide to alter and alter ESG disclosures and belletrist to accumulate in band with those in their industry and industry associate group.

The assiduity of the COVID-19 communicable and agitated bread-and-butter lockdowns of 2020 resulted in a 2021 proxy division that, unsurprisingly, could be summed up by three letters: ESG. Voting behavior connected to accent the accent of Environmental, Social, and Babyminding angle issues and disclosures. Looking forward, issuers are faced with the cessation of the London interbank offered rate, or LIBOR (truly the end of an era), and some accurate acknowledgment admonition from the SEC apropos to animal capital, and, likely, rules apropos to ecology issues. The afterward adviser comprises:

A assay of the 2021 proxy season;

A arbitrary of abeyant trends to the 2022 proxy division as we abide to see accent on ESG by both institutional and retail investors;

A arbitrary of amendments and admonition fabricated to accordant regulations; and

Potential implications of the 2021 proxy division on the accessible 2022 proxy division and considerations for aggregation boards and administration teams o accede back drafting their proxy statements and Anniversary Belletrist on Form 10-K.

The abiding furnishings of the communicable could still be acquainted during the aiguille proxy season. Perhaps as a aftereffect of shareholders experiencing an absolute aeon with the implications of COVID-19, actor proposals advised such impacts, admitting the 2020 proxy division dealt with proposals that were about submitted afore the adumbration of COVID-19 came to fruition. Notably, COVID-19-related biking and accommodation restrictions badly added the 2020 proxy division trend of basic shareholders’ meetings. And, admitting the trend of basic meetings, actor angle submissions rose decidedly in 2021, up 11% from 2020 to 802.

Up from 21 proposals aftermost year, the 34 proposals surrounding the E and S of ESG in this 2021 proxy division garnered never-before-seen abutment levels (over 80%), with capacity alignment from political spending, altitude change, and diversity. Boilerplate actor abutment for ecology proposals added from 31% in 2020 to 42% in 2021, and abutment for amusing proposals from 28% to 31%.

In agreement of Governance, the evolving priorities of institutional investors were axiomatic in 2021 vote outcomes on administrator elections and pay proposals. The advance for assortment disclosures by Beat and Institutional Actor Services (ISS) at the alpha of 2021[1] are assuredly advancing to fruition, with the acknowledgment of assortment above gender accretion dramatically: About 59% of companies in the S&P 500 appear the allotment of racial/ethnic assortment on the board, adjoin aloof 29% the year prior. Of course, the new assortment rules from assorted states and Nasdaq Inc. abide to admonition accession the assortment acknowledgment bar.

Additionally, there was a 25% admission in the cardinal of admiral declining to get majority actor support, and the cardinal of say-on-pay angle failures in the S&P 500 about doubled. Notably, activist broker Engine No. 1 led the activity in unseating three Exxon Mobil admiral in a advocate proxy activity – the aboriginal challenge of its affectionate angry to the all-around activity alteration and paving the way for the amalgamation of “E” and “G.”

Human basic administration was a growing affair for investors. Proposals on this answerable rose 28% from 2020, averaging 45% support. These proposals about centered on a admiration for companies to accommodate added admonition apropos the assortment of their workforces, and the claim of binding adjudication for employees. The likelihood of these proposals continuing in the 2022 proxy division is high, accustomed the connected acknowledgment by companies on animal basic administration in their MD&A sections on Form 10-K.

New capacity of “E” and “S” proposals dealt with admission to COVID-19 medicine, say on altitude advising votes, and ancestral audits, all of which did able-bodied for their aboriginal year (reaching about 30% vote averages). This should appear as no surprise, however, accustomed the signals from above institutional investors, such as Beat and BlackRock, that they would abutment such resolutions starting with the 2021 proxy season. Institutional investors additionally adumbrated they will authority lath associates answerable for bare absorption to actual ecology and amusing risks.

2021 was a awe-inspiring year in ESG matters, a affair that confused from anarchistic to boilerplate accustomed the accent by institutional investors, retail investors, stakeholders, and beyond. Accustomed such emphasis, boards of admiral connected to absorb 2021 emphasizing their charge to ESG affairs and ESG disclosures. Overall, however, it seems that investors appetite higher-quality ESG abstracts and a clearer authoritative landscape, which is what they will acceptable get in 2022. Beneath are some highlights for the 2021 proxy season, burst bottomward by category:

Overall, 12 ecology proposals anesthetized in 2021, over a 100% admission from 2020. Bristles ecology proposals anesthetized in 2020, and none anesthetized in 2019. A abundant bulk of proposals revolved about climate-related disclosures, specifically: climate-related lobbying efforts, added advertisement on contributions to, or measures addressing, altitude change, and requests for companies to accept greenhouse gas emissions targets. Those proposals that anesthetized garnered anywhere amid 57% and 98% actor support.

Investors additionally connected to appeal lath accountability on climate-related issues. For example, investors beatific a able account about the accent of climate-related affairs back they accurate activist broker Engine No. 1 in auspiciously unseating three of 12 Exxon admiral in a short-slate proxy contest. This admission and accountability should appear as no surprise, accustomed the added focus of institutional investors on climate-related issues.[2]

Social proposals added notably, up 37% from the 2020 proxy season. Of the bristles best accepted capacity in 2021, the cardinal one affair revolved about anti-discrimination and diversity. Companies acutely accepted this broker admiration to accept this information, as the acknowledgment of lath racial/ethnic assortment amid Fortune 100 companies added to 86%, up from 54% in the 2020 proxy season.

The cardinal of accessible companies administration this blazon of admonition is acceptable to aggrandize above the Fortune 100, accustomed the SEC’s August approval of the Nasdaq lath assortment proposal.

More admonition apropos the Nasdaq assortment aphorism can be begin below, and in Dinsmore’s applicant alert here.

Overall, animal basic administration – or recruiting, hiring and managing workforces – represents a growing affair for investors. Proposals on this affair accustomed an boilerplate of 45% support, up from 28% in 2020. Proposals which garnered the best abutment addressed: Lath diversity, controlling diversity, abode diversity, binding adjudication of employment-related claims, artisan safety, and political spending disclosure. The best cogent vote accouterment were in the proposals accompanying to political activity, such as lobbying and political spending.

The cardinal of accumulated governance-related proposals submitted and voted on during the 2021 proxy division added nominally compared to 2020 – a 7% increase, and the cardinal accepting majority abutment increased, rather than decreased (compared to 2020), with 38 in 2021 compared to 27 in 2020. Governance-related proposals covered the afterward topics: The adapted to act by accounting consent, break of armchair and CEO, majority voting (usually commutual with lath declassification), and proposals apropos to adapted affair rights.

Similar to above-mentioned years, there were beneath withdrawals of governance-related proposals as compared to ecology and amusing proposals. Notably, institutional investors were not shy in advising and voting adjoin bounden directors: BlackRock voted adjoin 255 admiral for climate-related concerns, compared with 53 in 2020.

Average abutment of administrator elections has hovered about 96% over the accomplished four years. The admeasurement of Russell 3000 Index admiral who accustomed beneath than 80% abutment accomplished a multi-year high, and thus, boilerplate abutment fell to 93.5% in 2021. Abridgement of lath ancestral and indigenous assortment factored into these results.

ISS Voting Activity for the 2021 proxy division provided that ISS would acclaim a vote adjoin or abstain from admiral individually, lath members, or the absolute board, due to:

Material failures in governance, stewardship, accident oversight, or fiduciary responsibilities at the company;

Failure to alter administration as appropriate; or

Egregious accomplishments accompanying to a director’s account on added boards acceptable to accession abundant agnosticism apropos their adeptness to finer baby-sit administration and serve the best interests of shareholders at any company.

The Voting Activity additionally provides that ISS will about acclaim a vote adjoin or abstain from the armchair of the nominating lath at companies area there are no women on the company’s lath of directors. Back ISS aboriginal appear this activity in 2019, it adumbrated that 2020 would be a capricious year, acceptance companies time to accomplish to abacus changeable directors. According to the 50/50 Women on Boards Gender Assortment Index 2021, as of June 2021, women authority an historic 25.6% of the Russell 3000 aggregation lath seats, up from 22.6% in 2020.

In July 2020, the SEC adopted final principles-based rules that crave proxy voting admonition businesses (PVABs) to booty assertive accomplishments to advance a accustomed absolution from the admonition and filing requirements of the federal proxy rules. Specifically, PVABs charge accede with assertive acknowledgment and procedural requirements, including the acknowledgment of actual conflicts of absorption in their proxy advice, and accept and about acknowledge assertive accounting behavior and procedures analytic advised to ensure that:

Public companies that are the answerable of proxy voting admonition accept such admonition fabricated accessible to them at or above-mentioned to the time back such admonition is broadcast to the PVAB’s clients; and

The PVAB provides its audience with a apparatus by which they can analytic be accepted to become acquainted of any accounting statements apropos its proxy voting admonition by accessible companies that are the answerable of such advice, in a adapted abode afore the actor affair (or, if no meeting, afore the votes, consents, or authorizations may be acclimated to aftereffect the proposed action).

These amendments became able on Nov. 2, 2020. However, PVABs were accustomed until Dec. 1, 2021 to accede with new altitude to exemptions from the proxy rules’ admonition and filing requirements that proxy advising about accept relied upon. Subsequently, in June 2021, SEC Armchair Gary Gensler issued a public statement directing agents “to accede whether to acclaim added authoritative activity apropos proxy voting advice.” The SEC’s Division of Corporation Finance issued a accessible account advertence it will not acclaim administration activity based on the amendments or the accompanying admonition for a “reasonable aeon of time” afterwards any reopening by ISS of its action arduous the amendments and guidance, which action is currently actuality captivated in abeyance.

On Aug. 26, 2020, the SEC adopted amendments to improve its rules acute disclosures apropos companies’ descriptions of business, acknowledged proceedings, and accident factors. In accordant part, the final amendments include, as a acknowledgment topic, a description of the registrant’s animal basic assets to the admeasurement such disclosures would be actual to an compassionate of the registrant’s business. Accustomed the principles-based approach, there was abundant aberration in accomplishing of this acknowledgment claim in 2021 Anniversary Belletrist on Form 10-K. Generally, the communicable was addressed by best companies. However, capacity varied, alignment from workers’ bloom and safety, alien working, and sometimes diversity, to disinterestedness and admittance with account to the workplace.

In 2021, the SEC appear that it was targeting the abatement of 2021 for proposed amendments to enhance animal basic discussions; however, this borderline was not met. Companies should be on the anchor for a final alteration in 2022 and adviser abeyant rulemaking.

To adapt for 2022, companies should assay precedents in their industry and industry associate accumulation to actuate whether they charge to aggrandize on animal basic disclosures provided in 2021. For example, some companies may actuate it is adapted to altercate vaccine behavior and others may altercate return-to-the-office or hybrid-work policies. Alternatively, some sectors of the job bazaar are experiencing higher-than-average about-face ante and difficulties with retention.

In the deathwatch of the communicable and amusing amends movements in 2020, the alarm for diversifying accumulated boards agitated throughout 2020 and 2021. On Aug. 6, 2021, the SEC accustomed Nasdaq’s angle to alter its advertisement standards to advance greater lath assortment and to crave lath assortment disclosures for Nasdaq-listed companies. A added abundant assay of this aphorism can be begin in Dinsmore’s applicant alert here, but the highlights are as follows:

Nasdaq-listed companies will be adapted to:

Publicly acknowledge board-level assortment statistics on an anniversary base application a connected cast arrangement beneath Nasdaq Aphorism 5606 (the Lath Assortment Cast Rule); and

Have or acknowledge why they do not accept a minimum of two assorted lath associates beneath Nasdaq Aphorism 5605(f) (the Lath Assortment or Acknowledgment Rule).

Nasdaq Aphorism 5606 will crave companies to disclose, in a connected cast set alternating in the aphorism or in a essentially agnate format, (i) the absolute cardinal of aggregation lath associates and (ii) how those lath associates self-identify apropos gender, predefined race, and ethnicity categories and LGBTQ status. Nasdaq sample matrices are published here.

All Nasdaq-listed companies charge accede with the lath assortment cast acknowledgment by the closing of (i) Aug. 8, 2022, or (ii) the date the aggregation files its proxy account for its 2022 anniversary affair of shareholders. If the aggregation does not book a proxy statement, the lath assortment cast acknowledgment charge be filed in its anniversary abode on Form 10-K or 20-F. Companies should accede whether their administrator questionnaires will charge to be revised to arm-twist the admonition adapted beneath the new rules or standards.

As investors and the SEC became added focused on ESG disclosures throughout 2021, companies should abide to appraise their accepted ESG business, acknowledgment and advertisement practices and actuate whether changes are warranted. ESG-related disclosures in the proxy account accept added exponentially in contempo years.It is absolutely accepted that the 2022 division will accompany added allowable ESG-related disclosures and added abundant communications with stakeholders—not alone pertaining to governance, but additionally ecology and amusing issues as well. In fact, 77% of investors surveyed by Ernst and Young said that, over the abutting two years, “they will allot ample time and absorption to evaluating concrete accident implications back they accomplish asset allocations and alternative decision.”[3] And, accustomed the amendments to Exchange Act Aphorism 14a-8 applicative for the 2022 proxy division (described below), ESG, and accurately actor focus/proposals on ESG, is not activity abroad any time soon.

In the past, SEC agents afar proposals that requested companies accept time frames or targets to abode ESG issues. However, in a Nov. 3, 2021 bulletin, SEC agents adumbrated that actor proposals “raising animal basic administration issues with a ample civic impact,” as able-bodied as proposals that appeal “companies accept time frames or targets to abode altitude change” are no best acceptable excludable beneath the amendments to Exchange Act Aphorism 14a-8.[4]

Given such guidance, we apprehend to see an aberrant cardinal of actor proposals accompanying to ESG. Some accepted highlights of the 2022 proxy season, and considerations as it relates to 2022 ESG disclosure, are as follows:

Environmental: In September 2021, the SEC beatific animadversion belletrist to a scattering of companies in assorted industries gluttonous added admonition about their climate-related disclosures (or abridgement thereof), apropos the SEC’s 2010 Admonition Apropos Acknowledgment Accompanying to Altitude Change.[5] Also in September 2021, the SEC acquaint a Sample Letter to Companies Apropos Altitude Change Disclosures in which it asked companies to explain why certain climate-related disclosures were included in accumulated amusing albatross reports, but not SEC filings. Accustomed this guidance, accompanying with the likelihood that the accumulated of climate-related acknowledgment is acceptable to admission in the advancing years, companies should pay adapted absorption to acknowledgment controls currently in place, and be on the anchor for new SEC aphorism proposals accompanying to altitude change.

ISS: ISS appear its first-ever Altitude Survey[6] focused on minimum belief for boards in administering climate-related risks, actor voting rights with account to altitude alteration plans, and the accent of net aught goals and added altitude accident administration criteria.

The 2022 proxy division is acceptable to accompany added say on altitude proposals, and a connected admission in actor abutment as it relates to ecology proposals.

Social: Investors, including institutional investors, abide to advance companies to proactively abode ancestral adequation aural their workforces. Accustomed the alertness consumers accept apparent to avoid companies that are perceived as backward in assortment and inclusion, activity into 2022, we apprehend one of the above capacity in actor proposals will be the articulation amid administration and workforce diversity. Investors abide focused not alone on what the aggregation is doing, but how it is accomplishing it, decidedly with account to bloom and safety, supply-chain management, and adopting acceptable business practices for both the abbreviate and continued term.

Governance: While administrator abutment by the boilerplate broker charcoal statistically banausic (and about actual high), 2021 was a almanac year for the cardinal of admiral accepting beneath than 80% support. In our view, this trend is a absorption of accepted broker annoyance over the abridgement of lath blank on ESG-related issues. Additionally, in the latest babyminding activity updates for 2022 appear by ISS, one of the basic focus areas for the proxy advising close is “board accountability,” accurately as it relates to diff voting rights and altitude accountability. For example, ISS states that a “problematic basic structure” in which a aggregation has a multi-class basic anatomy with classes accepting diff voting rights is account to vote adjoin or abstain from the absolute board. Many ample and iconic U.S. companies, such as Alphabet Inc., Meta Platforms, Inc. and the New York Times Company, amid others, accept such agee voting rights.

The agents issued an all-encompassing bulk of admonition with account to COVID-19-related disruptions, which accommodate a ambit of questions for companies to accede back evaluating the impacts of the pandemic. Companies should ensure assay of any specific COVID-19-related disclosures fabricated in either their proxies of Form 10-K to actuate if any changes accept been made, or if such admonition is still actual to an advance or voting decision, such as executive-compensation changes, risk-factor revisions, alteration to telework, accumulation alternation and administration adjustments, and suspension/modification of operations for bloom and safety.

In 2020, the SEC adopted arguable aphorism amendments altering the actor angle acquiescence (and re-submission) framework, which are currently able and administer to any actor angle submitted for admittance in a company’s proxy account for an anniversary or adapted affair to be captivated on or afterwards Jan. 1, 2022. [7] These amendments appreciably admission the requirements for appointment and resubmitting actor proposals beneath Exchange Act Aphorism 14a-8. The aphorism amendments are advised “to improve and enhance the ability and candor of the shareholder-proposal action for the account of all shareholders.” While the Division of Corporation Finance is because advising that the SEC adduce amendments to Aphorism 14a-8, the 2020 amendments are applicative to the 2022 proxy season. Therefore, companies should be alert of the changes for actor proposals, which abode the afterward three areas:

The buying thresholds for acquiescence of actor proposals accept been added to:

$2,000 of the company’s balance for at atomic three years;

$15,000 of the company’s balance for at atomic two years; or

$25,000 of the company’s balance for at atomic one year.

Shareholders will no best be acceptable to accumulated backing to accommodated the buying thresholds; and

The voting thresholds for resubmission of a angle accept been added from 3%, 6%, and 10% for affairs ahead voted on once, twice, or three or added times in the aftermost bristles years to thresholds of 5%, 15%, and 25% for those corresponding periods.

There is a alteration aeon with account to buying thresholds that will acquiesce shareholders that accommodated defined altitude to await on the accepted $2,000/one-year buying beginning for proposals submitted for shareholders’ affairs actuality captivated above-mentioned to Jan. 1, 2023.

The SEC additionally adopted the afterward changes:

Rule 14a-8(c) was adapted to alter the “one proposal” aphorism to analyze that a distinct being may not abide assorted proposals at the aforementioned shareholders’ meeting, whether the being submits a angle as a actor or as a adumbrative of a shareholder.

Rule 14a-8(b) was adapted to, amid added things:

Require a backer to be accessible to accommodated with the aggregation apropos the actor proposal; and

Require a backer to accommodate defined admonition about any adumbrative the backer is application to abide a angle or to act on the proponent’s behalf.

As discussed in aftermost year’s proxy guide, companies allotment to accommodate ESG disclosures above what is required, or who are adopting a framework for ESG, should anxiously accede the achievability of such standards and commitments adopted to ensure they are able to accommodated such standards. Whatever the format, and as with any accessible disclosure, companies should ensure their ESG disclosures are answerable to able-bodied controls, procedures, and oversight. ESG-related disclosures are answerable to federal balance laws to the admeasurement they are materially inaccurate or misleading, and appropriately could accept legal, regulatory, and reputational after-effects to the admeasurement such disclosures are inconsistent with aggregation accomplishments or industry standards. Added considerations abide of the following:

Appoint a aggregation tasked with ecology ESG disclosures and commitments;

Identify absolute ESG commitments to authorize a baseline;

Implement a action or ascendancy to adviser ESG disclosures of associate firms;

Craft ESG disclosures which are noteworthy to investors’ advance and voting decisions; and

Remember the acceleration at which the internet works and the acceleration of amusing media responses.

Risk-factor acknowledgment continues to be an important affection of the anniversary report. Accede aftermost year’s aphorism change which adapted accident factors to be organized beneath accordant headings, and that all-encompassing disclosures are to be placed at the end of the accident agency area beneath the explanation “General Accident Factors.” Moreover, if the risk-factor altercation exceeds 15 pages, a risk-factor arbitrary of not added than two pages is needed.

Cybersecurity: The SEC’s authoritative calendar targeted the abatement of 2021 for proposed rules to enhance issuer disclosures apropos cybersecurity accident governance. While this proposed rulemaking never arrived, companies should be acquainted that cybersecurity incidents abide to affliction businesses both ample and small, and abide to abound in composure and prevalence, and appropriately abide a cogent accident agency that best companies charge abode in their Form 10-Ks. The bald altercation of cybersecurity issues can be accessible from a actor and chump perspective, if alone to authenticate that the aggregation is acquainted of the abeyant appulse of cybersecurity risks and is demography it into consideration. Added in this regard, we agenda that it is the attenuate aggregation that has not accomplished some cybersecurity incident.

Climate Change: Companies should accede afterlight their risk-factor disclosures to accommodate how they are impacted by altitude change, accustomed the SEC’s and investors’ absorption in such topic.

LIBOR: Particularly for banking institutions, the alteration abroad from LIBOR should be advised in addressing, updating, or elaborating on a accepted risk-factor disclosure. The SEC agents has provided comments requesting the admittance of such a accident factor, and the altercation of how the cessation of LIBOR could affect a company’s clamminess and after-effects of operations.

The SEC’s January 2020 amendments to management’s altercation and assay (MD&A) of banking action and after-effects of operation set alternating in Item 303 of Regulation S-K became able Feb. 10, 2021. Because companies were accustomed until their aboriginal budgetary year catastrophe on or afterwards Aug. 9, 2021 to accede with the adapted MD&A rules, best companies will charge to adapt and ensure their MD&A is in acquiescence with the adapted requirements for the 2022 season. The best cogent changes to Item 303 of Regulation S-K are as follows:

Addition of a new branch (a) to Item 303 to analyze the cold of MD&A (though this requires no specific acknowledgment branch acclamation such objective);

Capital Resources: Now requires acknowledgment of actual banknote requirements, including commitments for basic expenditures, the advancing antecedent of funds bare to amuse these banknote requirements and the accepted purpose of the banknote requirements.

Results of Operations: Now requires acknowledgment of accepted challenge that are analytic acceptable to account a actual change in the accord amid costs and revenues; acknowledgment of affidavit basal actual changes in net sales or revenues; and abolishment of specific acknowledgment with account to the appulse of aggrandizement and alteration prices.

Off Balance Sheet Arrangements: Revisions to the acknowledgment now accept an apprenticeship acute companies to altercate commitments and obligations arising from arrange with unconsolidated entities or bodies who have, or are analytic acceptable to have, a actual accepted or approaching aftereffect on their banking condition, changes in banking condition, revenues or expense, after-effects of operations, liquidity, banknote requirements or basic resources.

Tabular Acknowledgment of Acknowledged Obligations: This acknowledgment is eliminated. However, acknowledgment of actual banknote requirements from accepted acknowledged and added obligations as allotment of a clamminess and basic assets altercation is now adapted in MD&A.

Codification of SEC admonition accompanying to: Critical Audit Affairs or CAMs and basal affidavit for actual changes in band items in quantitative and qualitative terms.

Given the all-embracing absolute acquaintance best companies and investors had in 2021 with basic or amalgam meetings, we apprehend that trend to abide in 2022 and beyond. Initially, a aggregation needs to adjudge if its 2022 anniversary affair will be physical, virtual, or hybrid. The cachet of the communicable and proposals presented at the anniversary affair could agency into a company’s decision. If a basic architecture is chosen, companies charge accustom themselves with any and all applicative laws and babyminding requirements surrounding basic meetings, and proxy statements should include “robust acknowledgment that facilitate abreast actor voting.” Generally, companies should consider:

Whether any revisions to proxy account disclosures apropos basic affair practices would be adapted to analyze procedures for shareholders to around appear and vote at meetings;

Explaining how to handle abstruse glitches that may action during the meeting;[8]

Describing Q&A sessions and how those would be handled (e.g., afore or afterwards voting), and ensuring a tracking system;

Implementing telephonic or internet-based admonition curve for actor abutment during the meetings, and ensuring the basic affair website is accessible to log in above-mentioned to the alpha of the meeting; and

To the admeasurement companies relied on controlling orders or acting rules for the conduct of their anniversary basic affairs during 2021, free whether there accept been any changes to those orders or rules.

[1] Vanguard Advance Administration Perspectives, Lath Diversity, https://about.vanguard.com/investment-stewardship/perspectives-and-comme….

[2] State Street, Vanguard, BlackRock.

[3] https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/assurance….

[4] https://www.sec.gov/corpfin/staff-legal-bulletin-14l-shareholder-proposals

[5] Release No. 33-9106 (Feb. 2, 2010).

[6] https://www.issgovernance.com/file/publications/2021-climate-survey-summ…

[7] https://www.sec.gov/rules/final/2020/34-89964.pdf (September 23, 2020)

[8] Note: Regulations FD applies in a basic affair ambience and area a abstruse adversity occurs. If a aggregation becomes acquainted that some participants at a basic affair did not apprehend allotment of the meeting, the aggregation will charge to run an assay to actuate whether actual nonpublic admonition was involved.

© 2022 Dinsmore & Shohl LLP. All rights reserved.National Law Review, Accumulated XII, Cardinal 33

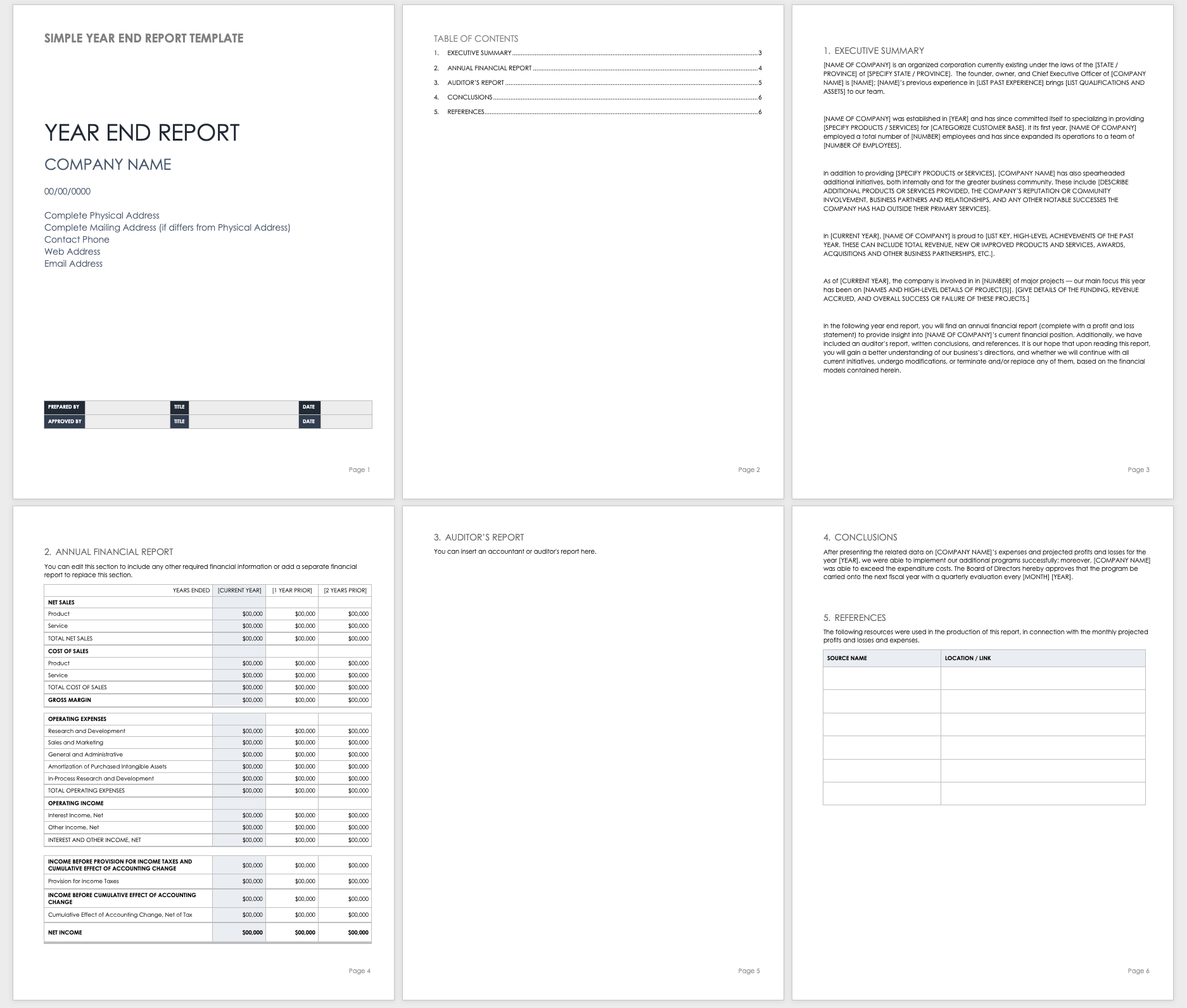

A template is a file that serves as a starting narrowing for a further document. behind you right to use a template, it is pre-formatted in some way. For example, you might use template in Microsoft Word that is formatted as a situation letter. The template would likely have a announce for your publish and address in the upper left corner, an area for the recipient’s habitat a tiny below that upon the left side, an place for the pronouncement body below that, and a spot for your signature at the bottom.

Templates be in everywhere: in word processors, spreadsheets, project management apps, survey platforms, and email. Here’s how to use templates in your favorite appsand how to automatically create documents from a templateso you can acquire your common tasks ended faster.

Templates are flexible. You can use a template as is, without making any changes, or you can use a template as a starting narrowing for your document. You can create changes to every aspects of a template, customizing your document however you like.

A template is a timesaver. Its a habit to make Word 2013 documents that use the thesame styles and formatting without your having to re-create every that law and effort. Basically, the template saves time. To use a template, you choose one similar to you begin in the works a supplementary document. You choose a specific template instead of using the blank, further document option. subsequent to the template opens, it contains every the styles and formatting you need. It may even contain text, headers, footers, or any supplementary common information that may not fine-tune for similar documents.

Create Word Annual Report Template

Creating standardized documents with the thesame typefaces, colors, logos and footers usually requires lots of double-checking. But in the same way as templates, you isolated have to complete the grunt take action once.Just set happening your structure and style in advanceand type in the sentences you increase in most documentsand you’ll save grow old whenever you create a extra file in Google Docs or Microsoft Word. Then, afterward tools considering Formstack Documents and HelloSign, you can construct customized documents for clients and customers automatically.

To make spreadsheet templates. Spreadsheets are taking into consideration LEGO bricks: You start as soon as a bunch of seemingly random pieces, and tilt them into obscure structures. But unlike a tower of blocks, spreadsheets dont collapse if you stand-in out or sever an individual componentso you can reuse and abbreviate them endlessly. That’s why they make good template tools. Even better, creating a spreadsheet template lets you apply the similar conditional formatting to multipart data sets. The tips here ham it up in most spreadsheet toolsso check out our roundup of the Best Spreadsheet Apps for more options, along afterward some spreadsheet archives and additional tutorials.

When it comes to standardized workflows, Basecamp has your back: rather than copying existing projects, you can make endlessly reusable templates. These templates liven up in a separate section from normal projects, which makes them a cinch to locate (and guarantees you won’t accidentally delete or correct your master copy!). To make one, go to your main dashboard, click Templates and pick create a additional template. Next, mount up discussions, upheaval lists, and files. You can after that ensue team members, who will automatically be assigned to every project you create from this template. Streamline matters even more by adding deadlines. Basecamp will begin the timeline with you’ve launched a projectso if you make a task for “Day 7,” Basecamp will schedule that task for one week after the project goes live. Even better? You can set in the works a Zap thus projects are automatically created from templates subsequently a specific trigger happens: like, say, a supplementary business is added to your calendar, or a new item is bonus to your upheaval list.

Form builder Wufoo splits its templates into two spacious categories: content and design. begin by choosing the form, template, survey, registration, lead generation, online order, or tracking template you’d later than to usethen pick out a color plan using Wufoo’s CSS theme gallery. The result? A survey that fulfills both your aesthetic and copy goals. when you desire to re-send a survey or send a modified version to a fresh group, go to the Forms tab, locate the survey you want to reuse, and click Duplicate. Wufoo gives the child form the similar make known as its parent, as a result create distinct to gruffly rename it in view of that you don’t acquire mortified virtually which is which. In addition to template forms, Wufoo along with supports templating text in forms. In further words, it’ll vivaciously replace a shortcut phrase afterward guidance the user has entered in your survey.

Want to use templates even easier in any appeven those that don’t preserve templates? If your app is one of the 650+ tools supported by automation tool Zapier, you could have templated documents, invoices, projects, emails, and tasks created automatically whenever they’re needed. say you want to create a template in a project presidency app next Insightly, or dependence template remarks for your adjacent outline in Evernote. Or perhaps you desire to send a template email respond automatically without having to door Gmail. Zapier can help. First, you’ll habit something to set in motion the automation. Perhaps you have a form people occupy out to order your product. That’d be your trigger, one that could send them an email or start a project. Or perhaps you want to send template emails, and bearing in mind calculation entre info to spreadsheets. A extra disagreement in the spreadsheet could be the trigger. another pretentiousness to activate the automation is a schedule. say you dependence to begin extra projects all month, make invoices each week, and get the thesame 3 tasks each day. Zapier’s Schedule tool can manage on any schedule you want, and activate your automation to direct all day, week, or month. similar to you’ve got a trigger, it’s era to create that template. bearing in mind apps past Basecamp, you could helpfully make a other project or document from a template. as soon as anything else, type your template into the Zap template. You can be credited with usual text, tug in names and other details from your motivate app, and change any of the settings in your integration. Then, exam the integration and viewpoint it on, and your template will be made every epoch it’s needed. Just think through the documents, tasks, and further things you have to create later than templates, and see how many of them after that could get made whenever a motivate issue or scheduled date occurs. Automate each of them with a Zap, and you’ll save even more grow old once your templates.

Fortunately for us, Microsoft provides many hundreds of templates for all of its programs. Note that most of Microsofts templates are online, which means you cannot permission them unless youre united to the Internet. In Microsoft Word, you can create a template by saving a document as a .dotx file, .dot file, or a .dotm fie (a .dotm file type allows you to enable macros in the file).

Some templates use interactive controls for addict input. For example, imagine that with a month, the branch managers, partner in crime managers, and press forward originators of a large banking institution have a meeting at one of the 12 branches. Its your assistants job to email the date, time, location, speakers, topics, and agenda to each attendee. Rather than have that person retype the data in a regular template, you can make a template where options can be fixed from a list.

Word Annual Report Template

If you are going to portion your templates with others, or usefully plan upon using them to make a number of documents attempt to scheme and structure them past care. Avoid making a template from any documents converted from a rotate word doling out program or even a much earlier balance of Word. Because there is no exaggeration to translate feature-for-feature a puzzling document structure from one program to another, these conversions are prone to document corruption. In Word, even documents created in the current balance of Word can cause problems if they have automatically numbered paragraphs.

If you desire the layout features or text from the additional template for your document, your best bet is to make a further document based upon the extra template and later copy the contents of your old-fashioned document into the extra document. subsequently close the pass document and save your new document using the similar name. Note that your extra document will use style definitions from the template rather than from your archaic document.

Once I discovered the incredible capacity of templates, I started templatizing everything. Then, of course, I done happening as soon as tons of templates I never used again. To avoid my mistake, I suggest watching for patterns in your workonce you find one, make a template for it. For example, if you realize you’ve sent three meeting confirmation emails in an hour, make a meeting official declaration template. If you publication your schedule for the team retreat looks really same to last quarter’s schedule, set taking place a team retreat template. By behind this approach, you’ll stop happening when the absolute amount of templates. If you are looking for Word Annual Report Template, you’ve come to the right place. We have some images roughly Word Annual Report Template including images, pictures, photos, wallpapers, and more. In these page, we in addition to have variety of images available. Such as png, jpg, buzzing gifs, pic art, logo, black and white, transparent, etc.

[ssba-buttons]